Uncategorized

Worried About Timing the Bitcoin Market? A ‘Lookback Call’ Might Be the Answer

Imagine you’re a bitcoin (BTC) bull, confident prices will rally, but anticipating a pullback first. Like many people, however, you are not adept at perfectly timing such market entries and feel you may miss the optimal moment to load up on bullish exposure.

For traders facing this common predicament, a structured product known as a lookback call may offer a compelling solution.

A lookback call is an exotic option that gives the holder the right to buy the underlying asset at its lowest observed price during the so-called lookback period.

For instance, instead of trying to pick the exact bottom of the current BTC price pullback from record highs, a trader may consider a three-month lookback with a one-month lookback period.

That means the strike price is set at the lowest value in the first month, and the call can be exercised at that level anytime before the option expires three months after it’s issued. So if the BTC price dropped to $100,000 in the initial month before rising to, say, $140,000 within three months, the holder could require the issuer to sell BTC at $100,000.

The option’s unique structure ensures the call buyer benefits from securing the perfect dip, maximizing their profit potential by eliminating the need for precise market timing. That’s in stark contrast a traditional call option from a centralized exchange, where traders must select a fixed strike price, significantly increasing the risk of a suboptimal entry.

«BTC spot remains near its highs, but implied volatility has collapsed. This combination makes lookback options particularly attractive from a risk-reward perspective,» Pulkit Goyal, head of trading at Orbit Markets, told CoinDesk. «With implied volatility at such low levels, the lookback feature offers perfect entry for limited extra cost.»

Orbit Markets, an OTC desk specializing in options and structured products, suggested a three-month lookback call to its clients, which will set the strike to the lowest bitcoin price over the next four weeks. The suggestion underscores a growing demand for sophisticated risk-management tools and highlights the increasing maturity of the crypto derivatives market.

The benefit of perfect entry comes at a cost, meaning the Orbit’s lookback call was priced at 12.75% volatility, somewhat higher than the 0.25% volatility for the regular call option. The issuer of the option is taking on the risk that BTC might drop, forcing them to give you a more favorable strike price. As a buyer, you pay extra that unique benefit.

What if BTC doesn’t drop?

It’s perfectly possible that BTC immediately rallies from the going market rate of around $115,000 and stays higher over the next four weeks before rallying further to $140,000 by the end of the three months.

In this case, the strike price is fixed at $115,000 after the one-month lookback period ends, giving the call holder the right to buy BTC at $115,000 on expiry.

In other words, even though the prices didn’t dip initially, the call buyer still got a good entry, profiting from the subsequent upward move.

Risk profile

The buyer of the lookback call option stands to lose the initial volatility premium paid if BTC crashes to levels below the strike price fixed after one month.

The risk profile, therefore, is similar to that of a standard call option.

Uncategorized

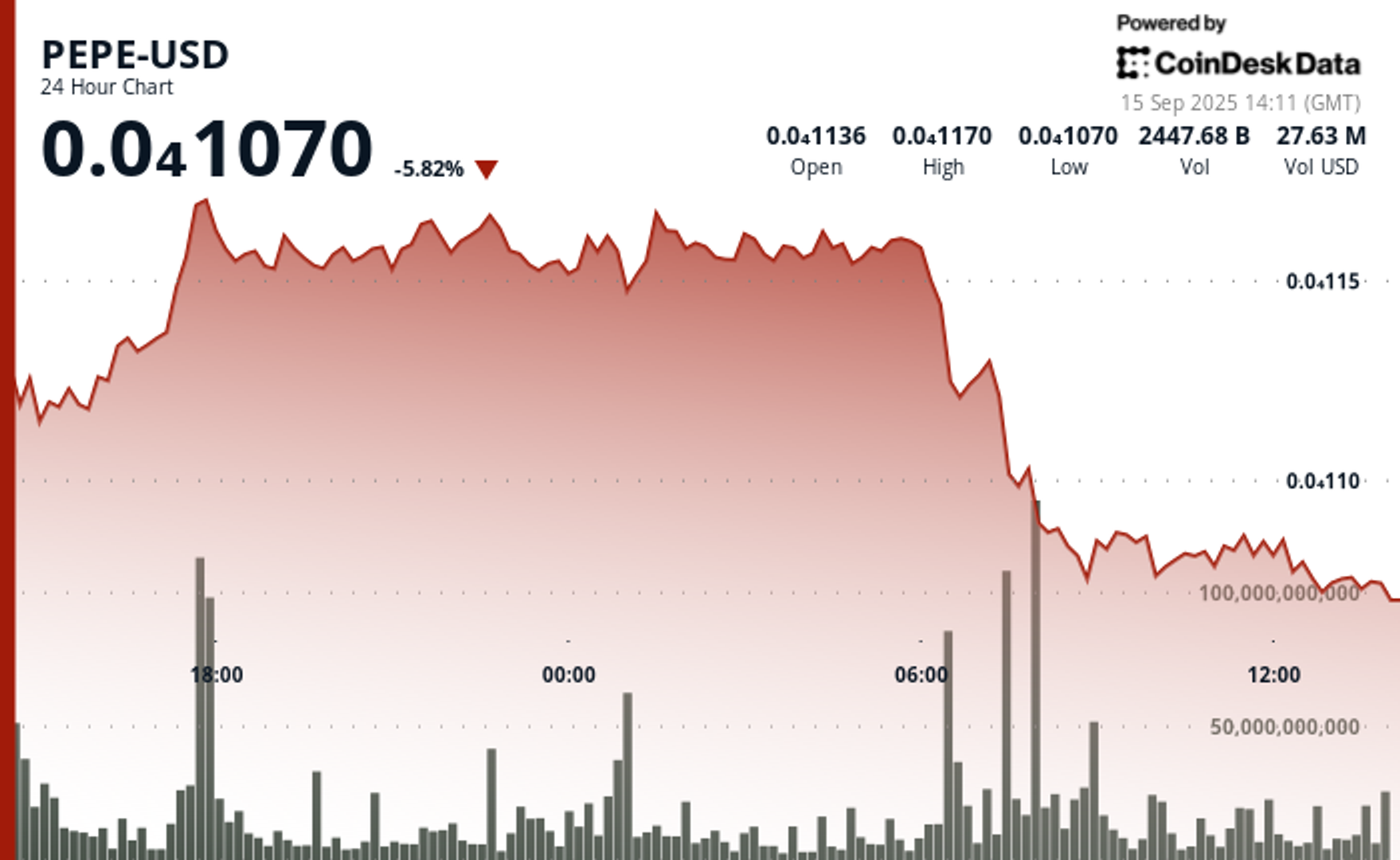

PEPE Price Sinks 6% Amid Market Sell-Off as Whales Accumulate

Meme-inspired cryptocurrency PEPE has lost nearly 6% of its value in the last 24-hour period, sliding to a $0.0000107 low even as large investors accumulate.

Trading volumes for the cryptocurrency surged into the trillions of tokens amid the drop, as the token kept failing to find support amid the intense selling pressure. The drop came amid a wider crypto market drawdown, where the broader CoinDesk 20 (CD20) index lost 1.8% of its value.

Memecoins were especially hard hit in the sell-off. The CoinDesk Memecoin Index (CDMEME) dropped nearly 5% over the last 24 hours, while bitcoin saw a drop of 0.8%.

The drop comes just days after altcoin season speculation grew among cryptocurrency circles over the Federal Reserve’s expected interest rate cut later this week, which is expected to be a boon for risk assets.

Data from Nansen shows that over the past week, the top 100 non-exchange addresses holding PEPE on the Ethereum network have seen their holdings grow by 1.38% to 307.33 trillion tokens, while exchange wallets had a 1.45% drop in holdings to 254.4 trillion tokens.

Technical Analysis Overview

PEPE’s price action pointed to a market in retreat, according to CoinDesk Research’s technical analysis data model. The token dropped from $0.000011484 to $0.000010782, with sellers dominating the chart.

Price peaked at $0.000011732 during a resistance test, but volume swelled to 5.5 trillion tokens at that level, before the market ultimately turned lower.

Support showed signs of buckling during the next phase, with the token brushing against $0.000010746. Trading activity intensified again, hitting 7.7 trillion tokens and reinforcing bearish sentiment.

The cryptocurrency’s price whipsawed within a 9% intraday range, a sign that traders remain unsure whether support levels are going to hold.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Digital asset treasuries (DATs), publicly traded firms that hold crypto on their balance sheets, have been hit hard in recent weeks as their market NAVs (mNAVs) slid below 1, Standard Chartered’s Geoff Kendrick said in a new report.

Looking ahead, ether (ETH) DATs appear to have the most staying power thanks to staking yield, regulatory clarity, and room to grow, argued Kendrick.

The mNAV ratio is crucial. When it falls, these firms lose the incentive (and sometimes the ability) to keep buying crypto, threatening a key source of demand for bitcoin (BTC), ether and solana (solana).

Kendrick said that the next phase for DATs will be one of differentiation. The winners will be those that can raise funds at the lowest cost, achieve scale that draws liquidity and investor attention, and, crucially, earn staking yield. That last point tilts the playing field toward ether and solana treasuries over bitcoin, which lacks yield.

Market saturation is also at play. Strategy’s success as the flagship BTC treasury has inspired a flood of copycats, nearly 90 at last count, who together now hold more than 150,000 BTC, up sixfold this year, the analyst noted.

But if mNAVs stay below 1, Standard Chartered expects consolidation. For BTC treasuries, that could mean firms like Saylor’s Strategy buying out rivals rather than buying new bitcoin on the open market, a coin rotation, not fresh demand.

Ether treasuries look better positioned. They have been aggressively accumulating, with 3.1% of ETH’s circulating supply purchased since June. The largest player, Bitmine (BMNR) is well-placed to keep adding to its 2 million ETH stack, the report said.

For crypto markets, this matters. DAT buying has been a key driver of bitcoin and ether prices in 2025. But with BTC treasuries facing consolidation pressure and solana treasuries still relatively small, Standard Chartered sees ETH as the likely beneficiary going forward.

Read more: Strategy’s S&P 500 Snub Is a Cautionary Signal for Corporate Bitcoin Treasuries: JPMorgan

Uncategorized

Ethereum Foundation Starts New AI Team to Support Agentic Payments

The Ethereum Foundation (EF) is creating a dedicated artificial intelligence (AI) group to make Ethereum the settlement and coordination layer for what it calls the “machine economy,” according to research scientist Davide Crapis.

Crapis, who announced the initiative Monday on X, said the new dAI Team will pursue two priorities: enabling AI agents to pay and coordinate without intermediaries, and building a decentralized AI stack that avoids reliance on a small number of large companies. He said Ethereum’s neutrality, verifiability and censorship resistance make it a natural base layer for intelligent systems.

Ethereum Foundation background

The EF is a non-profit organization based in Zug, Switzerland, that funds and coordinates the development of the Ethereum blockchain. It does not control the network but plays a catalytic role by supporting researchers, developers and ecosystem projects.

Its remit includes funding upgrades such as Ethereum 2.0, zero-knowledge proofs and layer-2 scaling, alongside community programs like the Ecosystem Support Program. The foundation also organizes events such as Devcon to foster collaboration and acts as a policy advocate for blockchain adoption.

In 2025, EF restructured to handle Ethereum’s growth, emphasizing ecosystem acceleration, founder support and enterprise outreach. The new dAI Team represents a continuation of this shift toward specialized units addressing emerging technologies.

Crapis’s role

Crapis is a research scientist at the EF and will lead the new dAI Team. He said the group will connect its work with both the EF’s protocol group and its ecosystem support arm.

“Ethereum makes AI more trustworthy, and AI makes Ethereum more useful,” he wrote, adding that the team intends to fund public goods and projects at the intersection of AI and blockchains.

ERC-8004 and Trust Standards

The group will build on recent work around ERC-8004, a proposed Ethereum standard that Crapis described as a way to prove who an AI agent is and whether it can be trusted. By offering identity and reputation systems for autonomous agents, the standard is intended to allow coordination without centralized gatekeepers.

Crapis said the team will support new standards and upgrades as they emerge, guided by Ethereum’s values and the “d/acc” philosophy of decentralized acceleration. The goal, he explained, is to ensure AI development remains open and verifiable while giving humans greater agency over how intelligent systems interact with the economy.

Why it matters

For Ethereum, the move signals a growing ambition to anchor emerging technologies beyond finance.

If AI agents begin transacting at scale, demand could grow for settlement rails, reputation systems and standards that run natively on Ethereum. For the AI community, the initiative offers an alternative to centralized platforms that currently dominate AI infrastructure.

“The more intelligent agents transact, the more they need a neutral base layer for value and reputation,” Crapis said. “Ethereum benefits by becoming that layer and AI benefits by escaping lock-in to a few centralized platforms.”

The team has begun hiring and publishing resources, according to Crapis. He said EF intends to work “with purpose and urgency” to connect AI developers with the Ethereum ecosystem and to accelerate research at the boundary of the two fields.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars