Uncategorized

Still Loving My ‘If It Went to Zero’ NFT

During the NFT boom of 2021, NFT-aficionados said “I’d love it even if it went to zero” as a tongue-in-cheek countercultural declaration that meaning and membership mattered more than profit.

It became kind of like a punk rock ethos in Web3. Burning money (figuratively or literally) was a flex to signal individual belonging to an in-group that positioned itself as the moral antithesis to the speculative frenzy that defined the time.

Like the early cypherpunks who fought for freedom and autonomy, or the Bitcoin maxis who held through multiple crashes, the next-gen NFT degens threw eyewatering amounts of magical internet monies at otherwise right-click-and-savable JPEGs to prove they understood the deeper layers of internet culture and crypto ideology.

But even the most ardent believers in blockchain’s promise are not immune to doubt when a long, cold Crypto Winter drains both capital and conviction. And the NFT bear has been grizzly.

Despite a flutter of activity in recent weeks—someone picked up 45 CryptoPunks for nearly $8 million, someone else grabbed an Ether Rock for over $300K, the Pudgy Penguins’ floor doubled, Moonbirds tripled—for the most part, the NFT market is down bad. At $156 million for July 2025, we’re nowhere near the crazy highs of August 2021 when OpenSea reported over $3 billion in NFT trading volume. For NFT art specifically, trading is down 93% since its 2021 peak.

So, assuming your beloved NFT is nearing its rock bottom, it’s time to check in and see: do you actually still love it?

If so, why do you still love it?

And you can’t just say: Oh, I love the art, otherwise a screenshotted JPEG would suffice.

Because to still love these things at their rock bottom, firstly, you have to be content with the value you paid in relation to the value you still get out of it.

Second, there has to be a reason for it to be an NFT. If it were just a pretty picture that can be saved, copied or shared without consequence, there’s no point in it being an NFT and no sacrifice in watching it go to zero.

As everybody’s favorite media theorist, Marshall McLuhan, would argue: the medium is the message. You don’t love the image more because of its content. You love it more because as an NFT, the image is something else. The NFT reprograms your role from mere viewer of the image to participant in a medium that tracks ownership, identity, value and status.

McLuhan believed every medium is an extension of ourselves. A book extends the eye. A phone extends the voice. Likewise with an NFT, we are in relation to an object in a way we could not have been if it were just a JPEG.

Bert Is Evil

With this in mind, let me present to you a case study for my beloved NFT: Bert is Evil.In November 2022, I bought an NFT that is very probably worth zero today. Called Bert is Evil, this was one of the first-ever viral internet memes (circa 1997), minted as an NFT by its original creator 25 years later.

Despite its rich history as an early online joke, it failed horribly as an NFT collection. Which is a very big part of why I love it. For me, the NFT is a priceless artifact that you could be marveling at in a museum.

It is an historical residue; an immutable memory from a failed crossing between two eras of the Web. It revealed the limits of translation between networks, eras and cultural grammars and how meaning and value in Web3 is not guaranteed by the act of minting.

The OG Meme

Before Pepe the Frog and Trollface, Wojak, LOL guy and GigaChad, there was: Bert is Evil. Prefaced perhaps only by Mr. T Ate My Balls and Dancing Baby, the early internet meme exposed the sordid secret life of one-half of the Sesame Street duo, Bert and Ernie.

Photoshopped into a series of mock photographs, the Muppet was pictured alongside history’s most infamous, from Jeffrey Dahmer and Lee Harvey Oswald to Hitler and the Ku Klux Klan. There was “evidence” of Bert smoking marijuana, fondling a young Michael Jackson’s crotch, and forcing Ernie to get a lap dance.

Another “photo” referenced an alleged deleted scene from Pamela Anderson and Tommy Lee’s leaked sex tape where the newlyweds had engaged in “a torrid orgy” with Bert.

Spawned in 1997 while he was still a student of Fine Arts at the University of the Philippines, the website was just a thing that twenty-something Dino Ignacio did to make his friends laugh. Armed with a hand-me-down 14.4 baud modem and a magazine collection spanning Omni Heavy Metal to Mad Magazine, Ignacio was a disciple of mashup culture at the internet’s dawn.

Bert quickly went viral, traveling through nascent internet forums, email chains and blogs. Back then, the web was participatory and anarchic. Remixing was rampant and authorship blurred, privileging circulation over provenance. Anyone could edit Bert; no one owned him. He mutated endlessly at the hands of Photoshop pirates long before terms like “fake news” entered our lexicon.

When Bert won a Webby, his popularity exploded. The website became so popular that Ignacio could no longer afford to run it on his own. Rather than shut it down, he zipped it up and offered it to others to mirror in exchange for hosting the original site. After decentralizing, hundreds of mirrors popped up across the world, increasing Evil Bert’s reach and notoriety.

Then, in 2001, an altered image of Bert and Osama Bin Laden appeared on protestor signs at a pro-Taliban rally. Ignacio felt it had gone too far. He shut down the website out of concern.

But the meme had a life of its own. It lived on.

The NFT

A quarter-century later, Ignacio had the idea to immortalize Bert is Evil as an historical, ownable object of record. Minting the meme as an NFT consciously resurrected an icon from a previous technological rupture. The gesture was not meant to be commercial but cultural: an act of media continuity.

Initially, my affection for the NFT was grounded in nerdy McLuhianism. But, as Bert failed to attract fans, my relationship to the NFT deepened.

I had learned about it by reading the maiden edition of Philippines Vogue (September 2022), where Ignacio had been profiled by the glossy in recognition of his impact on the technology industry. While Vogue is not the obvious place to get your NFT alpha, I was intrigued, thinking this unsold, unknown NFT might have been overlooked and undervalued.

In the story, the journalist probed Ignacio as to why he thought his NFT project was a flop. “Maybe I just don’t understand NFTs,” he said.

If I were a better investor, I would have recognized this as the red flag it was and continued to flip through my magazine. Instead, I jumped onto Foundation and bought the first of four in the collection. Within hours, a mutual friend had seen the transaction on-chain and connected Ignacio and I on Facebook DM.

Ignacio was shocked that one of his NFTs had finally sold, almost a year after the mint. His friend told him that I was someone in crypto so he agreed to a phone call and then, I heard the backstory. Ignacio said he felt like an imposter in Web3, disingenuous, foreign. While he was confident amongst his existing Web2 spheres orbiting game design, software development, VR, avatars and more, he didn’t feel the same credibility in Web3 and he blamed himself for not doing enough to publicize the mint.

Some of his friends offered advice on how to build hype, like diving into Discords, shitposting on Twitter and doing some Spaces. But Ignacio spent only a couple weeks before giving up.

Admission Requirements

While crypto is technically permissionless, the culture is less so. As much as the Web3 community loves to bang on about onboarding the next billion, and insists on branding itself as inclusive and empowering, for the most part, it is a clique with its own meeting places, rituals, language and admission requirements.

In Ignacio’s case, his Web2 pedigree — having held senior roles at Electronic Arts, Oculus, Facebook and Roblox — earned him few reputational points in Web3; sliding into Discord to rattle off those roles conjures that Steve Buscemi “How do you do, fellow kids?” meme.

The Bert NFT failed because Ignacio brought a Web1 artifact into a Web3 context using Web2 assumptions about reputation, attention and status. Ignacio was rightly respected in early internet circles. But he didn’t go to the effort to establish a presence in Web3 spaces.

Web3 is tribal and tight-knit with a bullshit detector fine-tuned to outsiders who haven’t done the time. Web3 doesn’t care who you were on other versions of the internet. Web3 gives zero fu*ks what you listed on your LinkedIn. You can’t just show up and expect your legacy to mint itself. Web3 wants to know what NFTs you’re collecting, what shitcoins wrecked you, what DAOs you’ve contributed to.

Wallets tell stories. And without real, verifiable involvement with crypto, the network sees you as read-only, not write-own. I mean, Ignacio admitted that he couldn’t even get into Crypto Twitter. My guess is that he was quickly labeled an extractor rather than a value-add. Which is, perhaps, the fastest way to kill an NFT project before it’s even launched.

For that reason, I wonder if Ignacio actually dodged a bullet. He never had to have that conversation with his patrons about why those Bert NFTs went to hell instead of the moon.

In a final, tragic, oh-so-crypto twist in the story, Ignacio was scammed when he clicked on a malicious link sent by email; a phony inquiry looking to buy one of the other Bert NFTs.

Ignacio DM’d me for help and after briefly looking into it, all I could tell him was that the 1 ETH I paid for Bert #1 was gone forever. This was particularly painful since Ignacio had committed to donating 50% of the proceeds of the collection to the Seattle affiliate of the Public Broadcasting Service. The only reason he hadn’t made the donation already was because I’d told him (back in 2022) it was better to wait til the whole collection sold, and in that time, the value of his ETH treasury would surely increase. In hindsight, that was the worst advice ever.

Not Yet Dead

And so, I thought, that was the end of the story. Bert was rich in meaning but poor in bids, had not sold by now, he was never going to sell. I wrapped my faithful homage to this market-resistant NFT, sent the article to my editor, and shot a DM to Ignacio to let him know something was coming out.

“Were you the one who purchased the second one?” Ignacio replied, with a link to a tx hash from a couple days ago.

Umm, what?! No! I did not buy Bert #2. So who did?

Searching the wallet address, I discovered it belonged to the Bureau of Internet Culture (BIC)—crypto’s historic immutable meme treasury, as described at their X profile. Browsing their collection valued over 900 ETH, I saw they held iconic internet memes as creator-minted NFTs including Me Gusta, Baton Roue, Vibing Cat, Unimpressed Nightclub Girl and Kevin, and had paid as much as 11.11 ETH for Dancing Baby and 36 ETH for Keyboard Cat.

I couldn’t believe it. These guys got it; this was the museum I always knew Bert belonged in.

I wondered: If Ignacio had known there was an on-chain collective that actually ‘got’ Bert, and who recognized Ignacio himself as a visionary whose online legacy deserved a place in a blockchain-based hall of fame… Then maybe, he wouldn’t have felt so alone in Web3?

And then I wondered: what if I was right in my original thinking that Bert was undervalued at 1 ETH? All it took was for this external body to agree that the NFT was worth buying and suddenly it was. Belief in value needs to be validated—through price action, cultural narrative, influencer support and community hype. And when that happens, the thing does indeed become valuable.

But hey, maybe I loved it even more when it was at zero.

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

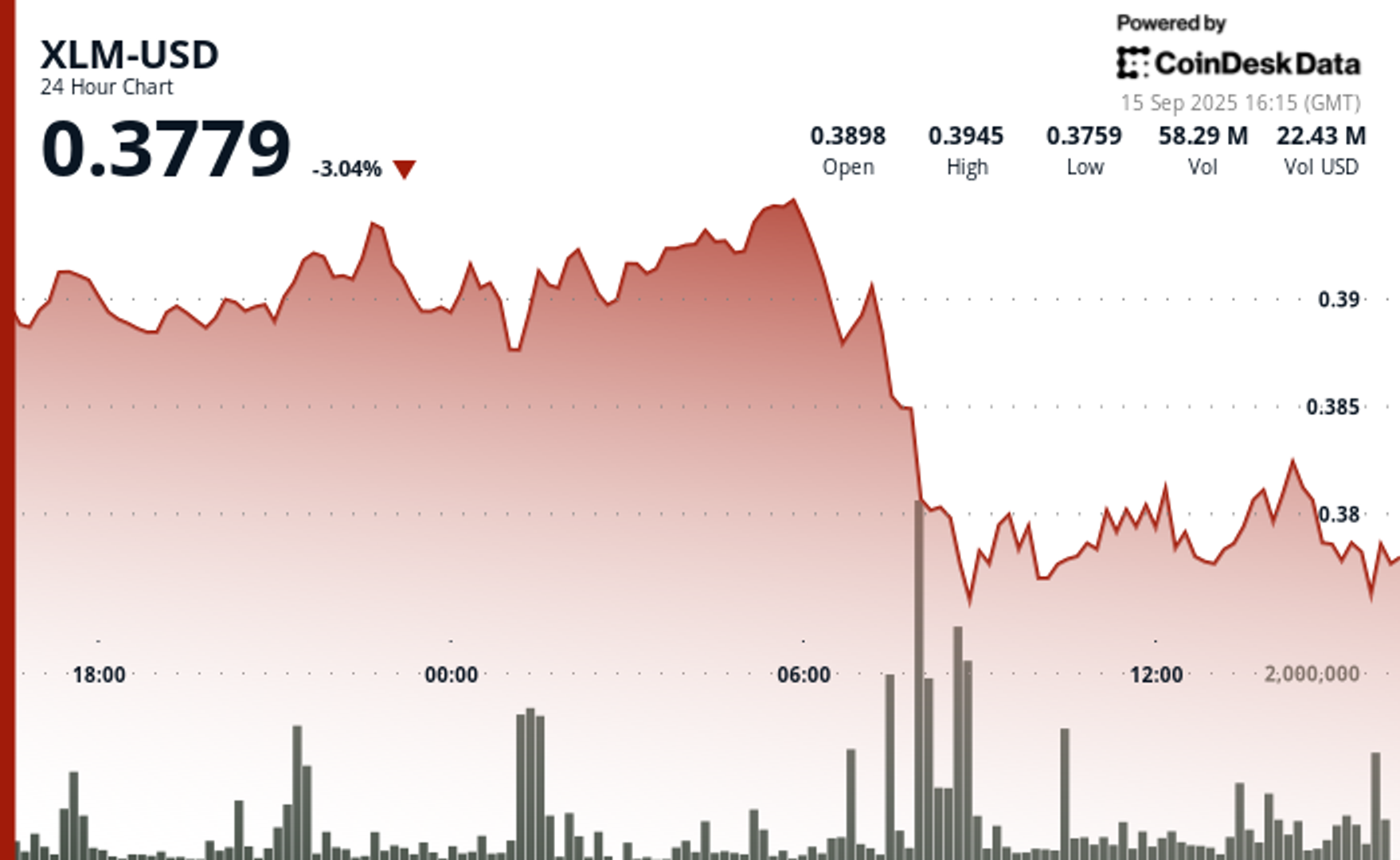

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

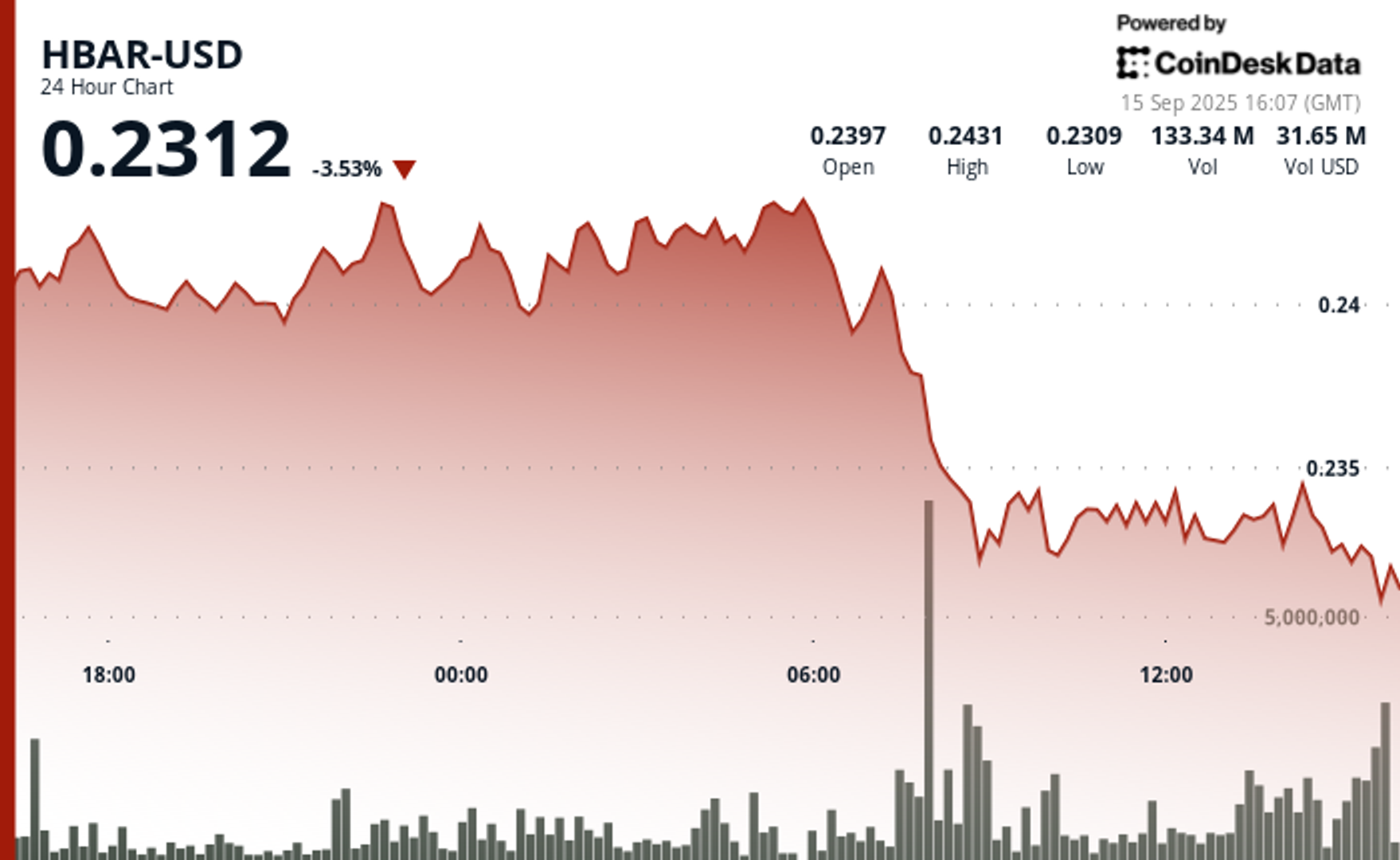

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars