Uncategorized

Crypto Industry Pitches Market Structure Ideas to U.S. Senators in Hearing

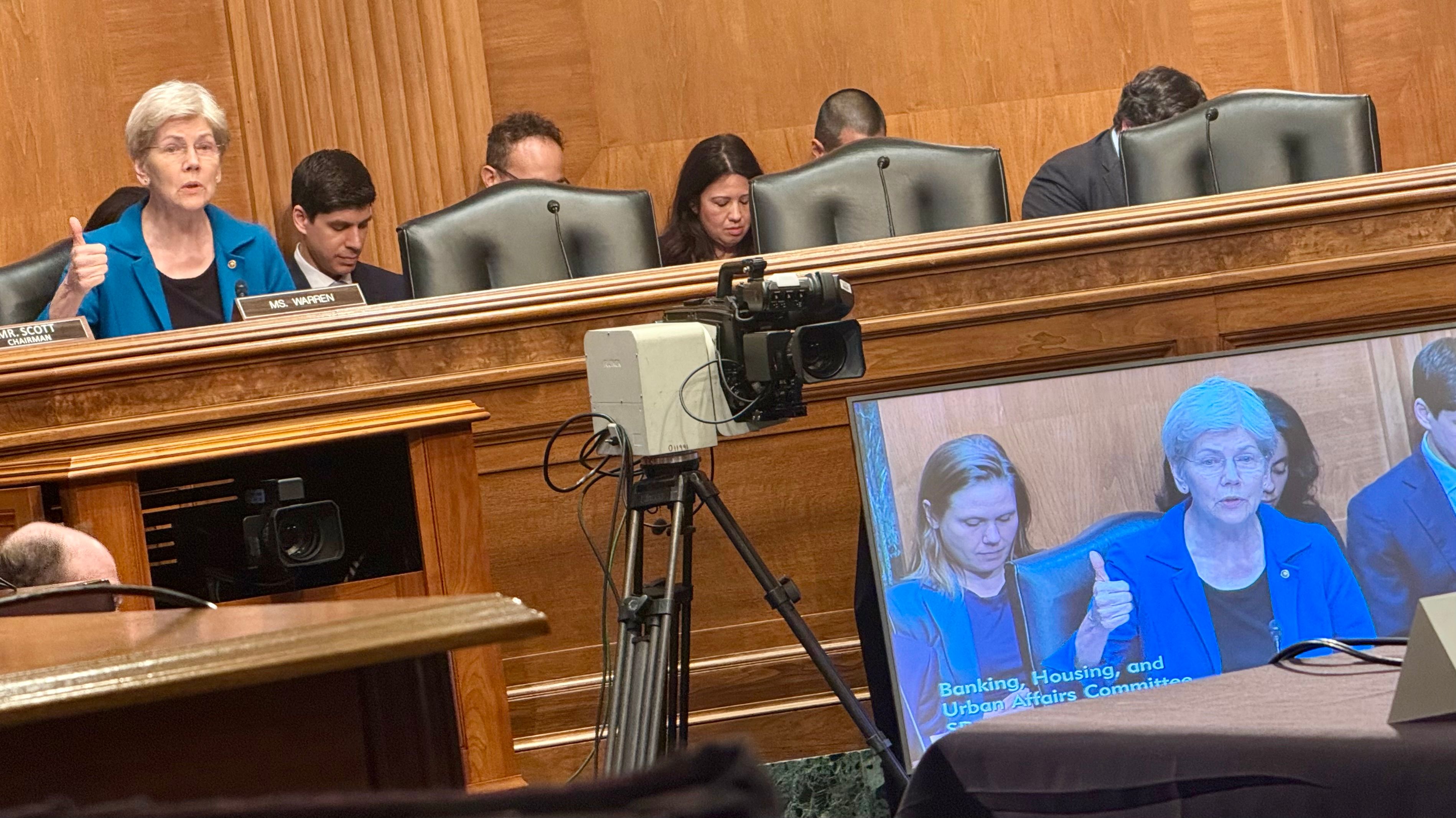

Crypto industry insiders including Ripple CEO Brad Garlinghouse outlined their hopes for how the Senate might seek to regulate digital assets markets in the U.S., while Senator Elizabeth Warren shared some of the top Democrat objections during a Wednesday hearing.

«For the last decade, the legal and regulatory uncertainty surrounding crypto has prohibited meaningful progress in the U.S.,» Garlinghouse told the Senate Banking Committee in his testimony. «At Ripple, we certainly saw firsthand how the lack of clear rules of the road can be weaponized to target good actors.» Ripple was one of the companies sued by the Securities and Exchange Commission, during President Donald Trump’s first term.

This is one of two Senate committees — also including the Senate Agriculture Committee — that need to work through the wide-reaching crypto market structure bill. The banking panel has so far moved more quickly, but their agriculture counterparts just scheduled their own hearing for Tuesday. And for its part, the U.S. House of Representatives is set next week for what leaders are calling «Crypto Week» to pursue a number of pieces of legislation, including that chamber’s own Digital Asset Market Clarity Act to establish legal infrastructure for the digital assets markets.

Banking Committee Chairman Tim Scott, a South Carolina Republican, noted during Wednesday’s hearing that he hoped the bipartisan momentum of the Senate’s successful vote on its Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 (GENIUS) Act — which the House will likely vote on next week as well — will continue as the panel turns toward the more important piece of crypto legislation.

«Passing GENIUS is more than just a legislative win,» Scott said of the bill to establish rules for U.S. stablecoin issuers, facing a House vote as soon as next week. «It’s a testament to what’s possible when Congress works together and puts principles before partisan politics.»

Senator Elizabeth Warren, the panel’s ranking Democrat who is one of the industry’s most reliable critics on Capitol Hill, opened her remarks on Wednesday suggesting there are a series of «principles that I think should guide our work,» not completely shutting the door on participating in a negotiation. But one of those principles was the increasingly contentious point that President Donald Trump’s personal interests in the crypto industry need to be dealt with.

Read More: Trump’s Crypto Ties Still Toxic With Some Dems, Including One Seen as Industry Ally

«The crypto industry may be calling the shots for Republicans, but nobody wants weak crypto rules more than the President of the United States,» Warren said. «If we’re going to provide rules of the road for crypto, we need to shut down the superhighway for presidential corruption at the same time.»

She also said that proposals including the House’s Clarity Act «will allow noncrypto companies to tokenize their assets in order to evade» regulation from the Securities and Exchange Commission.

«Think for just a minute about what that means,» Warren said. «Under the House bill, a publicly traded company like Meta or Tesla could simply decide to put its stock on the blockchain» to escape SEC scrutiny.

The House’s Clarity Act has already cleared the relevant committees in that chamber, so it’s the piece of legislation furthest along and has been suggested by Scott as a template for Senate work on market structure. One of the key provisions in the bill is to set up the Commodity Futures Trading Commission as a primary regulator of U.S. digital assets activity. A former chairman of that agency, Tim Massad, was among the witnesses on Wednesday and was asked about his thoughts on the act.

Massad responded, «I think it’s got a lot of problems. I think it’s 236 pages of regulatory arbitrage opportunities.»

Scott’s committee has previously set out a series of guidelines for its own work on market structure legislation that will «recognize the need to clearly define what is a commodity, what is a security, and how digital assets can trade and be custodied in a way that fosters innovation while protecting investors,» he said at the hearing.

«We don’t need more roadblocks,» he said. «We need rules that actually work.»

Trump has added urgency to the crypto policy debate in Congress at the moment, because he’d set his own August deadline for the Senate and House to produce stablecoin and market structure bills. While it’s possible the House signs off on the Senate’s stablecoin bill next week and sends it to the president to be signed into law, the timeline for the more complex bill may be further out. Senator Scott has declared a September 30 deadline for the Senate to finish market structure legislation.

Uncategorized

Deutsche Börse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets

Crypto Finance, a subsidiary of Deutsche Börse Group, unveiled AnchorNote, a system designed for institutional clients who want to trade digital assets without moving them out of regulated custody.

The system integrates BridgePort, a network of crypto exchanges and custodians, enabling off-exchange settlement and connectivity to multiple trading venues. By keeping assets in custody while allowing real-time collateral movement, AnchorNote aims to improve capital efficiency and reduce counterparty risk, according to a press release.

The service allows clients to set up dedicated trading lines, with BridgePort handling messaging between venues and Crypto Finance acting as collateral custodian, the press release said. Institutions can manage collateral through a dashboard or integrate the service directly into their existing infrastructure using APIs, it said. APIs, or application programming interfaces, allow software programs to communicate directly with one another.

“Institutional clients face a constant tradeoff between security and capital efficiency,” said Philipp E. Dettwiler, head of custody and settlement at Crypto Finance. “AnchorNote is designed to bridge that gap.”

For traders, the setup eliminates the need for pre-funding exchanges while providing immediate access to liquidity across platforms. In practice, a Swiss bank could pledge bitcoin held in custody and deploy it instantly across multiple trading venues without moving the coins on-chain.

The rollout begins in Switzerland, with Crypto Finance planning to expand across Europe.

Uncategorized

Bitcoin, Ether, XRP, and Dogecoin Lag Stocks as VIX Stirs Up Some Nerves

It’s a risk-on environment, with stocks leading major cryptocurrencies higher, but Wall Street’s fear gauge, the VIX, is stirring up some nerves.

On Monday, Wall Street’s benchmark index, the S&P 500, set a record high for the fourth consecutive trading day, reaching 6,519 points. The tech-heavy Nasdaq index also hit lifetime highs, and the Dow Jones traded near the peak recorded on Thursday.

Equities rose, disregarding the bearish September manufacturing survey, as bond yields fell in anticipation of a 25-basis-point Fed rate cut on Wednesday. According to the Fed funds futures, traders expect rates to drop to 3% from the present 4.25% within the next 12 months.

Still, bitcoin (BTC) lacked clear direction, as it traded back and forth between $114,000 and $117,000, forming an indecisive Doji candle. As of writing, it changed hands at $115,860, continuing a lacklustre trading pattern below record highs of above $124,000 hit in August.

The dour price action is likely due to long-term holders continuing to take profits and countering the bullish pressure from spot ETF inflows.

Other major tokens such as ether (ETH), XRP (XRP) and dogecoin (DOGE) have lost upward momentum too.

Ethereum’s ether token has pulled back from nearly $4,800 to $4,500 in three days, having put in lifetime highs above $5,000 last month. The weakness is perplexing, as ether, popularly known as the internet bond due to its staking yield mechanism, stands to become an attractive investment with the impending Fed rate cuts.

The payments-focused XRP has pulled back to $3.00, marking a weak follow-through to the bullish breakout from the descending triangle confirmed last week. Meanwhile, dogecoin, the leading meme token by market value, has dropped sharply to 26.7 cents from 30.7 cents amid reports of whale selling.

Analysts said that a 25-basis-point rate cut could resume the slow grind higher in BTC. Meanwhile, a surprise 50 bps move could see stocks, crypto and gold go berserk.

Keep an eye on VIX and BTC vol indices

Monday’s rise in U.S. stocks was characterized by an uptick in the VIX index, which represents the options-based implied or expected volatility in the S&P 500 over the next 30 days.

The VIX rose over 6% to 15.68 points. While it still largely hovers at multi-month lows, the Tuesday spike warrants attention for two reasons: First, historically, the two have moved in opposite directions, as evident from the correlation of nearly -90 over a 90-day period.

Secondly, a breakdown in the negative correlation often precedes corrections, as noted by the quant-driven market intelligence platform Menthor Q on X.

«SPX rose with the VIX today. This often signals stretched upside positioning, traders grabbing calls or hedging downside [with puts], leaving markets vulnerable,» Menthor Q said.

The VIX is influenced by demand for options, and Tuesday’s rise in the index could have been led by traders seeking S&P 500 puts or downside protection.

Perhaps, market participants anticipate a correction following the expected 25-basis-point Fed rate cut on Wednesday.

BTC implied volatility rises

Volmex’s bitcoin implied volatility index, which represents the expected price turbulence over 30 days, also rose by 3% Monday, maintaining its positive correlation with VIX.

Note that BTC’s historic positive correlation with implied volatility indices has flipped negative since the spot ETFs went live in January last year and more so since President Trump’s electoral win in November last year.

Uncategorized

Asia Morning Briefing: Fragility or Back on Track? BTC Holds the Line at $115K

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin (BTC) traded just above $115k in Asia Tuesday morning, slipping slightly after a strong start to the week.

The modest pullback followed a run of inflows into U.S. spot ETFs and lingering optimism that the Federal Reserve will cut rates next week. The moves left traders divided: is this recovery built on fragile foundations, or is crypto firmly back on track after last week’s CPI-driven jitters?

That debate is playing out across research desks. Glassnode’s weekly pulse emphasizes fragility. While ETF inflows surged nearly 200% last week and futures open interest jumped, the underlying spot market looks weak.

Buying conviction remains shallow, Glassnode writes, funding rates have softened, and profit-taking is on the rise with more than 92% of supply in profit.

Options traders have also scaled back downside hedges, pushing volatility spreads lower, which Glassnode warns leaves the market exposed if risk returns. The core message: ETFs and futures are supporting the rally, but without stronger spot flows, BTC remains vulnerable.

QCP takes the other side.

The Singapore-based desk says crypto is “back on track” after CPI confirmed tariff-led inflation without major surprises. They highlight five consecutive days of sizeable BTC ETF inflows, ETH’s biggest inflow in two weeks, and strength in XRP and SOL even after ETF delays.

Traders, they argue, are interpreting regulatory postponements as inevitability rather than rejection. With the Altcoin Season Index at a 90-day high, QCP sees BTC consolidation above $115k as the launchpad for rotation into higher-beta assets.

The divide underscores how Bitcoin’s current range near $115k–$116k is a battleground. Glassnode calls it fragile optimism; QCP calls it momentum. Which side is right may depend on whether ETF inflows keep offsetting profit-taking in the weeks ahead.

Market Movement

BTC: Bitcoin is consolidating near the $115,000 level as traders square positions ahead of expected U.S. Fed policy moves; institutional demand via spot Bitcoin ETFs is supporting upside

ETH: ETH is trading near $4500 in a key resistance band; gains are being helped by renewed institutional demand, tightening supply (exchange outflows), and positive technical setups.

Gold: Gold continues to hold near record highs, underpinned by expectations of Fed interest rate cuts, inflation risk, and investor demand for safe havens; gains tempered somewhat by profit‑taking and a firmer U.S. dollar

Nikkei 225: Japan’s Nikkei 225 topped 45,000 for the first time Monday, leading Asia-Pacific gains as upbeat U.S.-China trade talks and a TikTok divestment framework lifted sentiment.

S&P 500: The S&P 500 rose 0.5% to close above 6,600 for the first time on Monday as upbeat U.S.-China trade talks and anticipation of a Fed meeting lifted stocks.

Elsewhere in Crypto

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars