Uncategorized

The Big Bet on Crypto’s AI Infrastructure

Artificial intelligence is transforming the technology landscape, and it’s not just traditional players like Nvidia and Google that are shaping the future. A new, decentralized movement is emerging — one that merges AI and blockchain to create open, scalable and trustless infrastructure.

As AI systems demand increasingly powerful compute and reliable data systems, crypto-native platforms are stepping up. These systems aren’t just offering alternatives, they’re beginning to power real workloads and reimagine how AI is built and governed.

We’d love your feedback! CoinDesk is conducting a confidential survey. Start Survey.

Decentralized compute is getting real

The idea of decentralized GPU networks where users rent compute on demand and hardware owners earn income by sharing idle resources was once seen as futuristic. Today, it’s rapidly becoming operational, with platforms supporting live AI inference and training tasks.

io.net is one of the leaders in this space. With over 10,000 active nodes distributed, it delivers scalable compute-on-demand via decentralized infrastructure. The network uses advanced technologies like Ray-based distributed systems and proof-of-work/time-lock mechanisms to ensure reliability and efficient coordination.

Meanwhile, Aethir is positioning itself as an enterprise-grade alternative to traditional GPU clouds. With more than 400,000 high-end GPU containers onboarded including over 3,000 NVIDIA H100 and H200 units, Aethir is designed for performance-heavy AI workloads. Its network continues to scale as new cloud hosts join to meet demand across AI and gaming.

These platforms don’t just provide compute, they tokenize it. Through native incentives, they encourage participation from hardware providers and validators, while offering developers a scalable and often more cost-effective alternative to traditional cloud solutions.

Building a decentralized AI stack

Decentralized compute is just the starting point. An entire AI infrastructure is forming around blockchain-native principles such as transparency, verifiability and user ownership.

Model hosting is being reimagined by projects like Bittensor, which offers peer-to-peer training and inference across a global network. Its subnet architecture allows participants to contribute models, compete on performance and earn rewards, all without centralized oversight.

Data infrastructure is evolving, too. Filecoin has emerged as a decentralized storage solution capable of supporting large-scale AI datasets. Organizations like Singularity and Kite AI are now leveraging Filecoin to store not just raw data, but metadata and training resources as well, paving the way for private and decentralized data pipelines.

Investing in the future: AI tokens vs. big tech

For investors, crypto-native tokens offer a fundamentally different kind of exposure to the AI boom. While traditional equities like Nvidia or AMD provide access to the hardware and infrastructure layers of enterprise AI, tokens like Fetch.ai and Bittensor represent ownership in open, decentralized networks.

These projects are experimenting with peer-to-peer training, token-governed inference markets and decentralized agent economies. While riskier and more experimental than legacy tech companies, they also align with a bottom-up vision of AI, one that values participation, integrity and open access to compute and data.

What’s next

As decentralized AI ecosystems mature, a number of groundbreaking innovations are beginning to take shape:

- Autonomous AI agents: Self-operating agents capable of executing smart contracts, transacting on-chain and coordinating with other agents without human input.

- On-chain/off-chain interoperability: Hybrid models are emerging that bridge powerful off-chain AI with trust-minimized, on-chain logic and decision-making.

- Tokenized AI marketplaces: These platforms will allow developers and users to deploy, evaluate and monetize models and agents in transparent, decentralized environments that will open the door to human-to-agent and agent-to-agent economic networks.

The road ahead

The convergence of AI and crypto is no longer theoretical, it’s becoming an architectural shift in how intelligence is created, deployed and governed. If AI is to remain inclusive and secure, it must move beyond the closed, black-box systems.

Blockchain’s transparent, programmable infrastructure offers a compelling alternative. As decentralized networks scale, we’ll likely see an increasing number of AI applications built on-chain and governed by tokens, executed by global contributors and owned by the communities they serve.

Disclaimer: The author may hold personal positions in some of the tokens mentioned.

Uncategorized

Crypto Traders Eye $130K Bitcoin as Majors Price-Action Shows Market Structure Shift

Bitcoin’s rally to $120,000 this week has sparked a broader breakout across major crypto assets, with ether (ETH), Solana’s SOL, XRP, and dogecoin (DOGE) all posting high single-digit percentage gains.

However, this time, price action isn’t just about momentum, as traders claim that market structure is evolving under the weight of institutional influence.

“This isn’t a frenzied boom with no foundation,” said Seamus Rocca, CEO of Xapo Bank. “It’s a measured ascent, backed up by large institutional players with the long-term in mind.”

Rocca pointed to tight monetary policy and geopolitical volatility as reinforcing Bitcoin’s emerging role as a macro hedge, adding that “the momentum we’ve seen over the last 48 hours is clear. Bitcoin isn’t just growing in value, but also as a genuine asset class that is rivalling traditional finance.”

Ethereum, up over 17% on the week and briefly crossed $3,000, remains a primary beneficiary. «In Q2, corporate treasury purchases of BTC outpaced inflows into spot ETFs,» said the analytics team at Bitcoin yield protocol TeraHash in a note to CoinDesk.

«That points to strategic positioning. At the same time, custodians like Anchorage and Fidelity are scaling institutional pipelines, while OTC desks are tightening spreads.»

Solana, now trading around $163, gained over 11% on the week amid renewed demand across retail and memecoin ecosystems. The chain continues to act as a high-beta proxy for risk-on sentiment. XRP, meanwhile, jumped 25%, benefiting from both a technical breakout and rising speculation around regulatory resolution.

“Price action may grab the spotlight,” TeraHash added, “but the real breakthrough this summer is structural.”

The altcoin move is broad-based. Dogecoin has rallied 23% over the past week, driven by increased retail participation through platforms like Robinhood and Binance. XRP volumes have spiked on Korean exchanges, while Cardano, TRX, and AVAX are all trading firmly in the green.

Meanwhile, Bitpanda Deputy CEO Lukas Enzersdorfer-Konrad said that “strong bitcoin rallies are often followed by significant movements in altcoins with a slight delay — and a potential comeback of meme coins can’t be ruled out either.”

But not everyone sees a straight line up.

“Despite briefly touching this key milestone, BTC remains below a major resistance zone,” said Ruslan Lienkha, Chief of Markets at YouHodler, said in an email.

“A decisive breakout and sustained move above this level could trigger a sharp upward rally, potentially targeting the $130,000 range,” Lienkha added.

Uncategorized

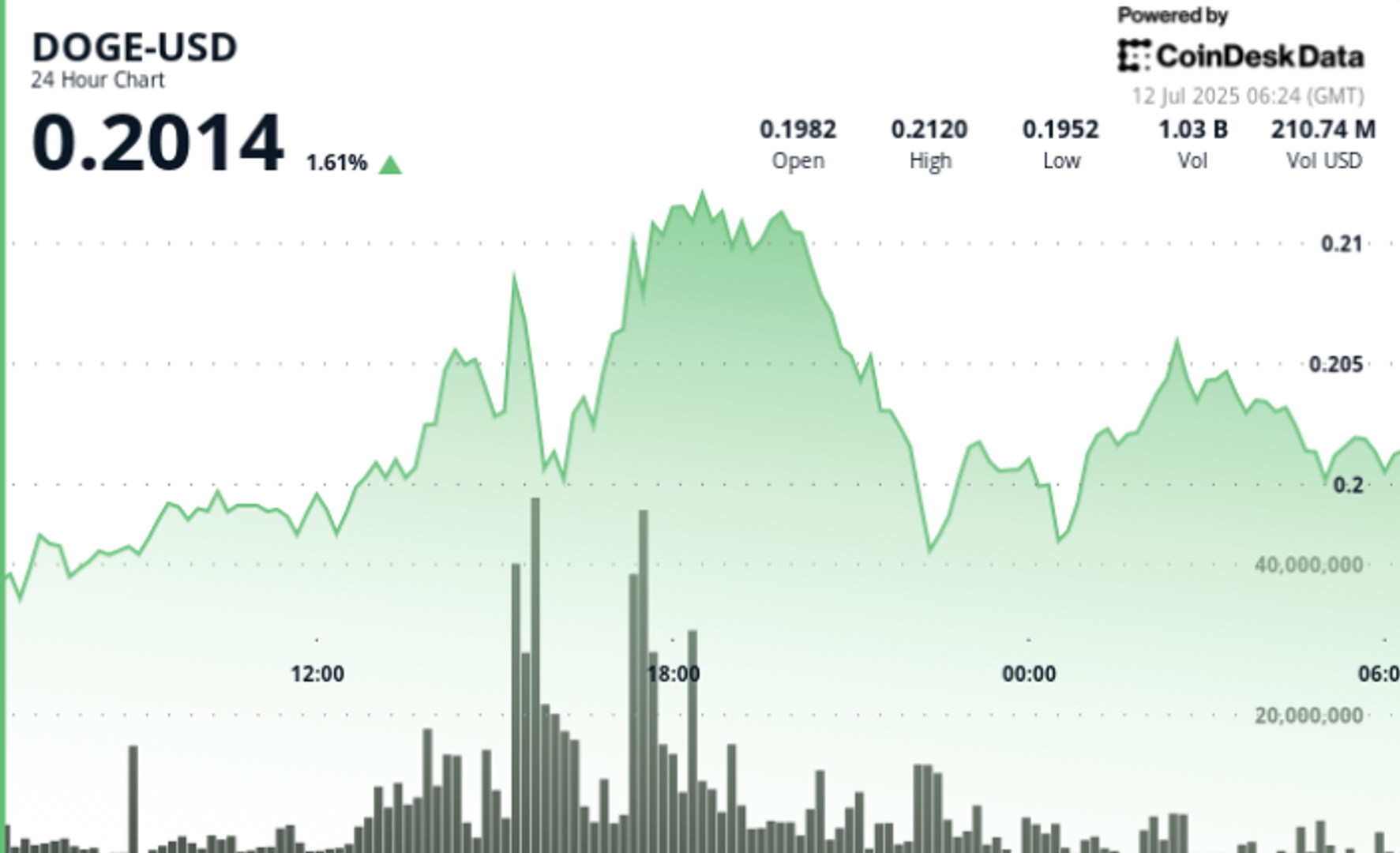

DOGE Surges 9% Before Sharp Reversal as $0.213 Resistance Halts Rally

What to know:

- DOGE advanced 8.6% from $0.198 to $0.213 between July 11 06:00 and July 12 05:00 before closing at $0.202 — a full retracement of its intraday gains.

- Trading volumes surged past 1.1B during the 13:00–15:00 session, establishing resistance between $0.208–$0.213.

- Support held at $0.200–$0.201 through late-session volatility, with final hour price action stabilizing around $0.202.

- Analysts flagged the rejection at $0.211 (20:00) as evidence of systematic profit-taking by larger holders.

News Background: BTC Record, Risk-On Flows Drive Meme Coin Rally

Bitcoin touched an all-time high of $118,000 during the session, as crypto markets benefited from a surge in institutional inflows — estimated at $50B this week alone.

Easing geopolitical tensions, improving trade relations, and dovish signals from central banks have boosted risk assets across the board. Dogecoin, typically a high-beta play during crypto rallies, surged alongside altcoins in response.

Price Action Summary

- Range: $0.198 → $0.213 → $0.202 | Total swing: 8.6%

- Breakout Zone: $0.200–$0.208 cleared on strong volume

- Resistance: $0.208–$0.213, with reversal from $0.211

- Support: $0.200–$0.201 tested and held multiple times

- Final Hour (04:55–05:54): Price rose from $0.200 → $0.202 (+0.5%)

- Volume Peak: 1.1B between 13:00–15:00; 19M during 05:00–05:10 late surge

Technical Analysis

- Mid-session momentum broke above key resistance zones but failed to sustain above $0.213

- Volume-backed reversal near session high suggests strategic exits by institutions

- Final-hour recovery shows $0.200 remains psychologically significant

- Momentum cooling; near-term consolidation expected in $0.200–$0.204 band

What Traders Are Watching

- Can DOGE reclaim and hold above $0.208–$0.210 to retest highs?

- Breakdown below $0.198–$0.200 would signal trend exhaustion

- Consolidation above $0.202 would support a bullish continuation setup into next week

- Broader BTC and macro risk sentiment will continue to dictate altcoin flows

Takeaway

DOGE followed broader crypto markets higher with a clean intraday breakout — but its rejection at $0.213 and sharp pullback highlight the fragile nature of meme coin rallies during high volatility sessions.

Institutional flows remain, but traders should watch for volume confirmation before chasing upside. $0.200 is now the line in the sand.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Why is XRP Up Today? Whale-Driven Rally Sends Ripple to Nearly $3

What to know:

- XRP rallied 8% from $2.58 to $2.78 between July 11 06:00 and July 12 05:00, with an intraday high of $2.96 at 15:00 before retracing.

- Afternoon price action saw exceptional volume — over 375M between 13:00–15:00 — with buyers repeatedly defending the $2.70–$2.75 zone.

- A $14.03M leveraged long was opened on Hyperliquid at $2.30, signaling aggressive whale positioning.

- Analysts now target $2.90–$3.40 as the next resistance band, citing bullish structure and capital inflows.

- News Background

Whale wallets have ramped up exposure in recent sessions, most notably with a $14M long established on derivatives venue Hyperliquid. - The trade coincides with a breakout from an ascending triangle structure and a growing belief among technical analysts that the $2.90 region, once cleared, could spark a fast leg toward $3.40 and beyond.

- This comes as Ripple’s broader ecosystem — including RLUSD stablecoin momentum and cross-border settlement integrations — continues to attract institutional interest.

Price Action Summary

- Range: $0.35 | Low: $2.58 → High: $2.96

- Peak Time: 15:00 | Sharp retracement followed, but price held above $2.70

- Support Zone: $2.70–$2.75, where demand remained intact through multiple tests

- Final Hour (04:55–05:54): XRP rose from $2.76 → $2.79 (+1%)

- Volume Spike: 2.6M between 05:30–05:35 validated breakout toward session close

Technical Analysis

- Price formed an ascending triangle with higher lows and horizontal resistance tests

- Total trading range of $0.35 = 14% volatility on session

- Afternoon resistance at $2.96; consolidation at $2.78

- Key breakout zone remains $2.90–$3.40; breach would likely trigger accelerated upside

- Late-session breakout confirmed by real volume, not thin order books — a key bullish sign

What Traders Are Watching

- Can XRP flip $2.80–$2.85 into a new base?

- Watch for reaction near $2.90; a clean move through that zone with >200M volume may open path to $3.40

- Failure to hold above $2.70 could invite pullback toward $2.58–$2.60

- Whale long at $2.30 continues to act as downside anchor for bullish bias

Takeaway

Real flows, strong technical structure, and aggressive leveraged positioning underpin XRP’s 8% daily move. The $2.96 rejection showed local resistance, but recovery into the close points to renewed strength.

A confirmed breakout above $2.90 could mark the start of a new bullish leg — with traders already eyeing $3.40 and, in ultra-bullish cases, $5+ as long-term targets.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business9 месяцев ago

Business9 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion9 месяцев ago

Fashion9 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business9 месяцев ago

Business9 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Tech9 месяцев ago

Tech9 месяцев ago5 Crowdfunded products that actually delivered on the hype