Uncategorized

Tariffs Don’t Budge Bitcoin, PNUT Pops on Musk Rant: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

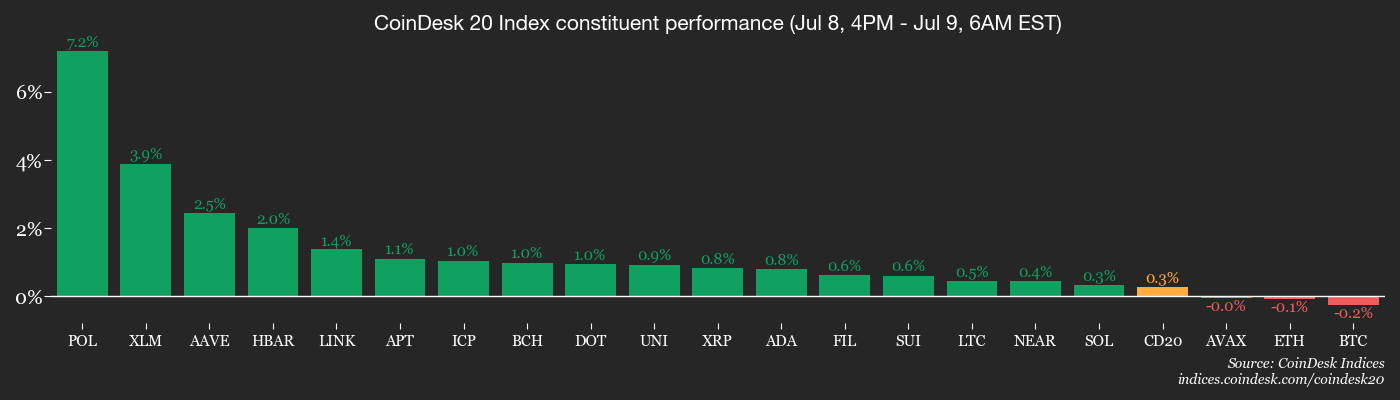

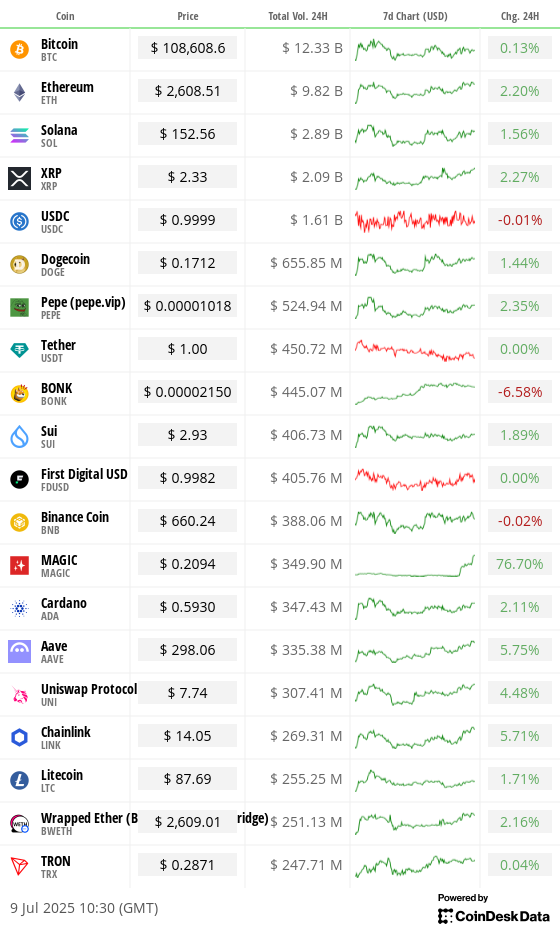

Bitcoin (BTC) is hovering around $108,600, pretty much unchanged over 24 hours. The broader CoinDesk 20 (CD20) index added 1.8%, shrugging off the uncertainty surrounding President Trump’s recent tariff threats against various countries.

President Donald Trump sent letters to 14 nations, including key partners in Asia, warning that tariffs will be applied starting Aug. 1 unless they make concessions to the U.S. when it comes to trade. Trump also said he will impose a 50% tariff on imported copper and up to 200% on pharmaceuticals.

Traditional markets were also muted in their responses. U.S. equity indexes were flat in yesterday’s session, while Europe opened with a slight upward momentum and Asian indexes closed higher. The U.S. dollar index is pretty much unchanged.

The market’s reaction suggests the so-called TACO — Trump always chickens out — trade is still in play. It’s a reference to the president’s negotiation pattern, in which tariffs are announced and then reversed. That’s even after he said “there will be no change” to next month’s deadline.

Still, past tariff announcements stoked inflation concerns, and this latest one comes as the Federal Reserve tightens liquidity to the tune of $40 billion a month, according to analysts at crypto hedge fund QCP Capital.

Fed Chair Jerome Powell has warned that tariff‑driven price spikes might delay any rate cuts, which would make risk assets like crypto less attractive for investors.

Nevertheless, earlier scares of a U.S. recession have cooled, with perceived odds of that happening this year dropping to 20% on Polymarket, the lowest since January.

Over the past week, cryptocurrency investment products brought in nearly $1 billion in net inflows, according to CoinShares data, pushing total assets to a record $188 billion. Bitcoin funds captured the lion’s share of those flows, with ether, solana and XRP funds logging solid demand.

Combined with a stream of corporate treasuries raising funds to buy bitcoin, demand remains elevated for the leading cryptocurrency.

Apart from exceptions like PNUT and some Grok-influenced memecoins, other altcoins aren’t faring as well. Bitcoin’s dominance has risen nearly 12% year-to-date to now account for roughly 65% of the ecosystem’s total market capitalization.

Whether the TACO trade will hold its merit ahead of the August deadline remains to be seen. Stay alert!

What to Watch

- Crypto

- July 9, 11 a.m.: The Isthmus hard fork activates on Celo (CELO) mainnet, an Ethereum layer-2 network, aligning its L2 stack with Ethereum’s Pectra upgrade and improving scalability, interoperability and security through key Ethereum Improvement Proposals.

- July 10: Polygon (POL) PoS set to activate the Heimdall hard fork on mainnet, reducing finality time to around 5 seconds, and bringing «faster checkpoints, smoother UX, safer bridging, and head-room for the next wave of upgrades.»

- July 14, 10 p.m.: Singapore High Court hearing on WazirX’s Scheme of Arrangement, marking a critical step in the exchange’s restructuring after the $234 million hack on July 18, 2024.

- July 15: Alchemist staking update launches, allowing token holders to stake ALCH for access to advanced features, premium benefits and ecosystem rewards, potentially boosting token utility and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing digital asset settlement network for institutions. Built on Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury fund shares, Lynq enables instant settlement, continuous yield accrual and improved capital efficiency.

- Macro

- July 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases June consumer price inflation data.

- Core Inflation Rate MoM Est. 0.38% vs. Prev. 0.3%

- Core Inflation Rate YoY Est. 4.22% vs. Prev. 4.06%

- Inflation Rate MoM Est. 0.27% vs. Prev. 0.28%

- Inflation Rate YoY Est. 4.31% vs. Prev. 4.42%

- July 9, 10 a.m.: U.S. Senate Banking Committee holds a hybrid hearing titled “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets” with CEOs of Blockchain Association, Chainalysis, Paradigm and Ripple testifying. Livestream link.

- July 9, 2 p.m.: Release of Federal Open Market Committee (FOMC) minutes from the June 17–18 meeting.

- July 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June consumer price inflation data.

- Inflation Rate MoM Est. 0.2% vs. Prev. 026%

- Inflation Rate YoY Est. 5.32% vs. Prev. 5.32%

- July 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended July 5.

- Initial Jobless Claims Est. 235K vs. Prev. 233K

- Continuing Jobless Claims Est. 1980K vs. Prev. 1964K

- July 10, 1:15 p.m.: Fed Governor Christopher J. Waller gives a speech at an event hosted by the Federal Reserve Bank of Dallas and the World Affairs Council of Dallas/Fort Worth. Livestream link.

- July 10–11: The fourth Ukraine Recovery Conference in Rome, bringing together global leaders and stakeholders to advance Ukraine’s recovery and reconstruction as the war with Russia drags on.

- July 11, 8:30 a.m.: Statistics Canada releases June employment data.

- Unemployment Rate Prev. 7%

- Employment Change Prev. 8.8K

- Aug. 1, 2025, 12:01 a.m.: Reciprocal tariffs take effect after President Trump’s July 7 executive order delayed the original July 9 deadline, making this the start date for higher tariffs on imports from countries without trade deals.

- July 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases June consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Compound DAO is running multiple votes on whether to adopt an Oracle Extractable Value (OEV) solution for Ethereum mainnet, Unichain, Base, Polygon, Arbitrum, Optimism, Scroll, Mantle, Ronin and Linea. Delegates can choose between implementing Api3, Chainlink’s Secure Value Relay (SVR), or keeping the current setup without OEV. Voting for all ends July 12.

- July 9, 1 p.m.: Livepeer (LKPT) to host a Fireside Chat.

- Unlocks

- July 11: Immutable (IMX) to unlock 1.31% of its circulating supply worth $10.48 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $51.01 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $14.73 million.

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $14.65 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $31.31 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating supply worth $789.99 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $89 million.

- Token Launches

- July 9: RCADE Network (RCADE) to be listed on Binance, Gate.io, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Shaurya Malwa

- Elon Musk’s late-night post slamming U.S. authorities for euthanizing a viral squirrel named Peanut while failing to charge anyone from Jeffrey Epstein’s alleged client list sparked a frenzy around the Solana-based memecoin PNUT.

- PNUT jumped over 10% within minutes and saw 24-hour trading volumes more than triple to $214 million, according to CoinGecko data, as traders rushed in on the name-drop.

- The token has no affiliation with Musk or the squirrel and no underlying utility. It trades purely on cultural resonance and speculative momentum.

- A separate, AI-driven event took hold after Grok, the chatbot on X, hallucinated a bizarre response referencing “MechaHitler,” “GigaPutin” and “CyberStalin” — terms that quickly went viral.

- Within hours, over 200 MechaHitler-themed tokens had launched across Solana and Ethereum, with the largest on Bonk.fun hitting a $2.2 million market cap and over $1 million in early volume, DEXTools data shows.

- At least one Ethereum-based version touched a $500,000 market cap, highlighting how quickly speculative capital chases meme narratives.

- The episode highlights how AI-generated content — even hallucinatory or unhinged — is now a legitimate trigger for on-chain trading activity, rivaling traditional influencer-driven pump-and-dump schemes.

- Grok later walked back the comment, clarifying the name referred to a 1990s video game character from Wolfenstein 3D and was meant as satire, not endorsement.

Derivatives Positioning

- The cumulative notional open interest in ether USDT and dollar-denominated perpetuals listed on major exchanges has risen above 5 million ETH, the highest since June 20, alongside positive funding rates to suggest a bias for long positions. BTC perpetuals remain as dull as the spot price.

- XRP’s open interest holds steady near five-month highs, also exhibiting a bullish market sentiment.

- On Deribit, options market activity shows $110K as price magnet for BTC and $3.20 as the focus for XRP. BTC and ETH 25-delta risk reversals showed a mildly bullish bias across tenors.

- Block flows featured a BTC calendar spread and a long put position in the July 18 expiry put at the $106K strike financed by writing the same expiry $108K strike call.

Market Movements

- BTC is unchanged from 4 p.m. ET Tuesday at $108,608.62 (24hrs: +0.05%)

- ETH is up 0.34% at $2,608.51 (24hrs: +1.8%)

- CoinDesk 20 is up 0.95% at 3,143.28 (24hrs: +1.28%)

- Ether CESR Composite Staking Rate is unchanged at 2.97%

- BTC funding rate is at 0.0033% (3.6507% annualized) on Binance

- DXY is unchanged at 97.60

- Gold futures are down 0.60% at $3,297.00

- Silver futures are up 0.45% at $36.63

- Nikkei 225 closed up 0.33% at 39,821.28

- Hang Seng closed down 1.06% at 23,892.32

- FTSE is up 0.28% at 8,879.27

- Euro Stoxx 50 is up 1.12% at 5,432.32

- DJIA closed on Tuesday down 0.37% at 44,240.76

- S&P 500 closed unchanged at 6,225.52

- Nasdaq Composite closed unchanged at 20,418.46

- S&P/TSX Composite closed down 0.43% at 26,903.57

- S&P 40 Latin America closed up 0.48% at 2,708.14

- U.S. 10-Year Treasury rate is down 1.2 bps at 4.405%

- E-mini S&P 500 futures are up 0.15% at 6,281.25

- E-mini Nasdaq-100 futures are up 0.15% at 22,932.00

- E-mini Dow Jones Industrial Average Index are up 0.14% at 44,576.00

Bitcoin Stats

- BTC Dominance: 64.95 (-0.17%)

- Ether to bitcoin ratio: 0.02403 (0.08%)

- Hashrate (seven-day moving average): 889 EH/s

- Hashprice (spot): $58.92

- Total Fees: 4.55 BTC / $493,193

- CME Futures Open Interest: 147,955

- BTC priced in gold: 33.1 oz.

- BTC vs gold market cap: 9.30%

Technical Analysis

- The Dollar Index (DXY) has topped a bearish trendline, representing the sell-off from February highs.

- It’s a sign of dollar bulls looking to reassert themselves.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $396.94 (+0.32%), +0.22% at $397.82

- Coinbase Global (COIN): closed at $354.82 (-0.64%), +0.56% at $356.82

- Circle (CRCL): closed at $204.81 (-1.28%), unchanged in pre-market

- Galaxy Digital (GLXY): closed at $19.46 (-1.17%), +0.36% at $19.53

- MARA Holdings (MARA): closed at $17.52 (+4.6%), +0.11% at $17.54

- Riot Platforms (RIOT): closed at $11.57 (+0.17%), +0.61% at $11.64

- Core Scientific (CORZ): closed at $14.02 (-5.46%), +0.57% at $14.10

- CleanSpark (CLSK): closed at $11.60 (+2.38%), +0.26% at $11.63

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.9 (+0.04%)

- Semler Scientific (SMLR): closed at $41.71 (+7.09%), unchanged in pre-market

- Exodus Movement (EXOD): closed at $32.12 (+7.32%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $75.3 million

- Cumulative net flows: $49.91 billion

- Total BTC holdings ~1.25 million

Spot ETH ETFs

- Daily net flow: $ 46.7 million

- Cumulative net flows: $4.52 billion

- Total ETH holdings ~ 4.21 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The total value of stablecoins issued on the Tron blockchain climbed to a record high above $80 billion.

- The tally is still significantly less than Ethereum’s $128.8 billion, according to data source Artemis.

While You Were Sleeping

- Donald Trump Deal to Leave EU Facing Higher Tariffs Than U.K. (Financial Times): The EU is nearing a framework deal with 10% tariffs on most goods — the same baseline rate as the U.K. — though the latter appears to have an edge on sectoral terms.

- Key Market Dynamic Keeps Bitcoin, XRP Anchored to $110K and $2.3 as Ether Looks Prone to Volatility (CoinDesk): Market maker positioning is damping volatility in BTC and XRP while amplifying it in ETH, where hedging flows may fuel sharper price swings above $2,650.

- Eigen Labs Axes 25% of Staff to Focus on Building EigenCloud (CoinDesk): The startup cut 29 jobs to shift resources toward EigenCloud development. EigenLayer and EigenDA — its restaking and data availability protocols — will continue to operate as part of the new platform.

- Anthony Pompliano’s ProCap Appears Better Than Peers Based on the BTC HODLer’s Own Data (CoinDesk): ProCap BTC, which holds 4,950 BTC and plans to go public in a $1 billion SPAC deal, says it trades at the lowest implied NAV premium among major bitcoin treasury firms.

- Bitcoin Treasury Firms Expand War Chests as Global Adoption Rises (CoinDesk): Of the $278 million raised by H100, Remixpoint and LQWD, $215 million came from Japan’s Remixpoint, which plans to use it to grow its treasury to a near-term target of 3,000 BTC.

- Israel Is Now Peerless in the Middle East and Markets (Bloomberg): Israel’s currency, equities and bonds have outperformed global peers since June 13 as investors signal confidence in its regional military dominance and prospects for rapid economic growth.

In the Ether

Uncategorized

Asia Morning Briefing: The First AI vs BTC Environmental Impact Numbers are Here. And it Might Start a New Debate

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Mistral AI recently offered a rare benchmark in the Artificial Intelligence industry’s environmental disclosure, detailing the footprint of its flagship large language model, Mistral Large 2.

Over 18 months, training and operating this model generated 20.4 kilotonnes of CO₂-equivalent emissions, consumed 281,000 cubic meters of water, and depleted 660 kilograms of antimony-equivalent materials, Mistral’s report said. Notably, a single 400-token response from its chatbot, Le Chat, uses just 1.14 grams of CO₂, 45 mL of water, and 0.16 milligrams of mineral resources.

But how does this compare to bitcoin’s carbon footprint? After all, bitcoin’s energy use has been the subject of significant debate and is often cited when establishing bans on bitcoin mining in jurisdictions.

That makes AI inference seem downright frugal compared to Bitcoin’s proof-of-work engine. On average, one Bitcoin transaction emits between 600 and 700 kilograms of CO₂, consumes more than 17,000 liters of water, and generates over 130 grams of electronic waste.

Zooming out, the entire Bitcoin network emitted roughly 48 million tonnes of CO₂ in 2023, according to the Cambridge Centre for Alternative Finance. It also consumed over 2 billion liters of water and produced more than 20,000 tonnes of e-waste.

However, the Cambridge Centre’s numbers, although peer-reviewed, have been the source of considerable criticism and require important caveats.

First, Bitcoin’s electricity mix is not monolithic.

According to a survey of miners conducted by BTC Investment fund Batcoinz as of March 2023, Hydropower (23.1%), wind (13.9%), and solar (5%) collectively account for more than 40% of Bitcoin’s energy consumption. The difference between the numbers is because surveys done by Batcoinz include off-grid generation.

Nuclear energy, often considered carbon-neutral, accounts for another 7.9%. Gas and coal together represent 44%, but Bitcoin’s energy profile is more diversified than critics often assume.

Second, LLMs may benefit from a cleaner grid by default. For example, nuclear energy comprises over 22% of the European Union’s electricity generation, which reduces the CO₂ emissions associated with model training and inference in EU-based data centers such as Mistral’s.

That advantage isn’t due to model architecture, it’s grid geography. A U.S.-based training run drawing from coal-heavy regions would present a very different environmental profile.

So while the marginal footprint of using an LLM is vastly smaller than processing a BTC transaction, both operate within infrastructure landscapes that significantly shape their true environmental impact.

Training frontier models like GPT-4 or Gemini can still require millions of GPU-hours and heavy water consumption, depending on location. Still, Bitcoin’s design, mining every 10 minutes regardless of demand, results in a fixed energy cost that scales with time, not usage.

In contrast, AI’s marginal cost scales with the frequency of model usage. That distinction makes the emissions from a chatbot reply easier to amortize than those from a block reward.

As global scrutiny increases over the environmental costs of computation, transparency initiatives like Mistral’s, provide important reference points.

While proof-of-work is energy-intensive, the Bitcoin blockchain’s halving mechanism steadily reduces the rate at which new coins are created, encouraging miners to become more efficient over time. Its environmental footprint should be weighed against the utility it provides in securing a decentralized, global financial network.

Continued improvements in clean energy adoption and mining optimization will be key for both BTC and AI as they scale into core pillars of the digital economy.

Market Movers:

BTC: Bitcoin is trading at $119,500, struggling to maintain momentum after last week’s all-time high of $123,100, as retail-driven sell pressure on Binance has pushed Net Taker Volume below $60 million and signaled growing bearish sentiment, according to CryptoQuant.

ETH: Ether has pulled back over 3% to $3,696 after a multi-week climb toward $4,000, as technical indicators flash red and analysts question whether the rally can continue without a broader correction, despite ongoing institutional accumulation.

Gold: Gold prices rose nearly 1% on Tuesday, with spot gold reaching a five-week high of $3,430.41 amid ongoing trade uncertainty and falling US bond yields, which continue to draw investor interest.

Nikkei 225: Asia-Pacific markets opened higher after U.S. President Donald Trump announced a “massive Deal” with Japan, lifting tariffs to 15% on Japanese exports, with the Nikkei 225 rising 1.71% at the open.

S&P 500: US stocks closed mixed Tuesday, but the S&P 500 edged slightly higher to a record 6,309.62 as investors weighed earnings reports

Elsewhere in Crypto:

Uncategorized

Dan Tapiero Projects Crypto Economy Hitting $50T, Launches $500M Fund Under New Firm

Well-known digital asset investor Dan Tapiero is merging private equity firms 10T Holdings and 1RoundTable Partners under a new brand 50T, reflecting his forecast that the digital asset ecosystem will reach a market value of $50 trillion in the next decade.

«50T is a natural evolution from our original thesis in 2020 when we launched 10T with the belief that the digital asset ecosystem would grow from $300 billion to $10 trillion in 10 years,» Tapiero said in a Tuesday press release.

«Today, we estimate that we’re already at $5 trillion, far exceeding our initial timeline, which is why we’re adjusting our outlook upward,» he said. «Recent successes like the Circle IPO and Deribit acquisition demonstrate the maturity of this sector and validate our investment thesis that all value will eventually move on-chain.»

USDC stablecoin issuer Circle surged nearly 10-fold from its initial price following its the stock market debut last month, while crypto exchange Coinbase acquired Deribit for $2.9 billion in May.

Funds under 50T were investors in Circle, Deribit, and digital trading platform Etoro, which also went public recently, and other portfolio companies are also gearing towards going public, the press release said.

50T is also launching a $500 million growth equity fund dubbed 50T Fund alongside the rebrand.

It’s a closed-end fund with a ten-year horizon, designed to back later-stage companies building out core infrastructure in blockchain and web3, with a first close planned in Q4 2025.

Uncategorized

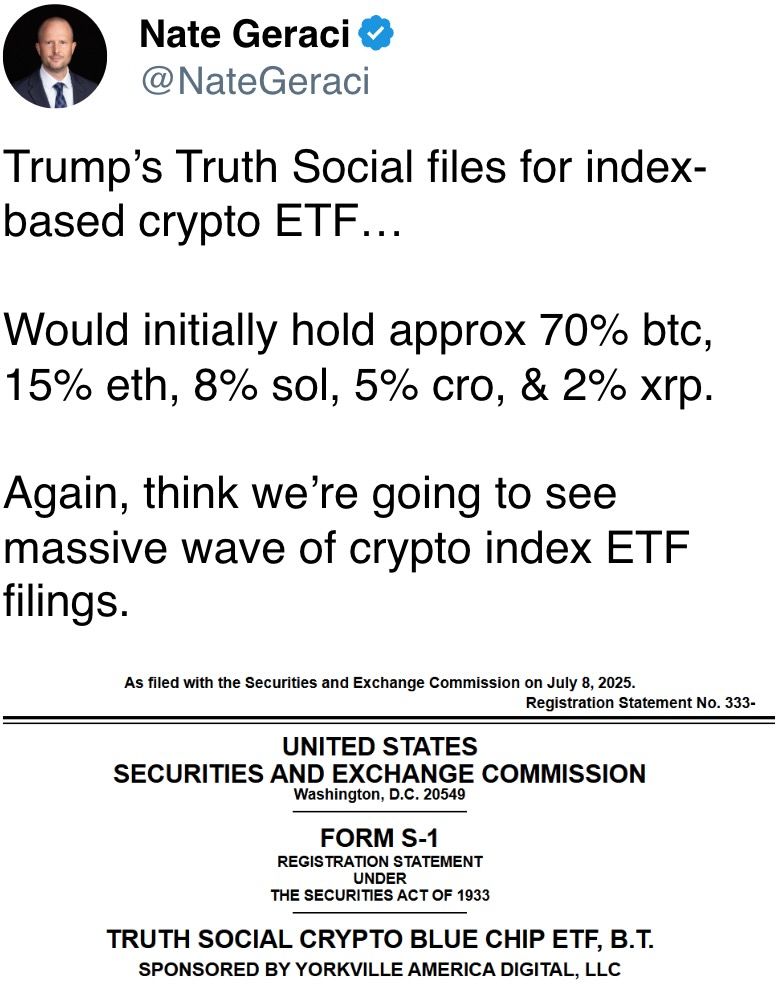

SEC Approves, Immediately Pauses Bitwise’s Bid to Convert BITW Crypto Index Fund to ETF

The Securities and Exchange Commission approved — then abruptly paused — Bitwise’s plan to convert its Bitwise 10 Crypto Index Fund (BITW) into a spot exchange-traded fund (ETF) on Tuesday, raising fresh uncertainty around the agency’s standards for crypto ETFs.

The fund holds 90% of its weight in bitcoin (BTC) and ether (ETH), with the remainder spread across Solana (SOL), XRP, Cardano (ADA), Avalanche (AVAX), Chainlink (LINK), Bitcoin Cash (BCH), Uniswap (UNI) and Polkadot (DOT). It manages $1.68 billion in assets and rebalances monthly.

Bitwise launched the fund in 2017. The 2.5% expense ratio remains steep by ETF standards, but the conversion to a spot ETF would make BITW the first multi-asset crypto index ETF in the U.S. — if it proceeds. The asset manager has not yet disclosed if the management fee would stay at 2.5%.

A similar product, Grayscale’s Digital Large Cap Fund (GDLC), which tracks BTC, ETH, XRP, SOL and ADA, also received initial SEC approval before the agency reversed course, pausing the fund’s launch.

A letter from the SEC on Tuesday said «the Commission will review the delegated action,» identical wording to the letter Grayscale received when its ETF was paused.

According to sources who spoke to CoinDesk at the time, the SEC’s hesitation likely stems from the need to establish consistent standards for crypto ETFs, particularly for tokens like XRP and ADA that do not yet have standalone ETFs.

The SEC’s ETF docket has been busy. On Tuesday, the regulator published filings from Franklin Templeton, Fidelity, Invesco Galaxy, and others seeking to amend redemption mechanics for their Bitcoin and/or Ethereum ETFs. It also launched a review of the Canary Capital SUI ETF and extended the deadline on 21Shares’ SUI ETF application.

Separately, 21Shares filed a proposal for an ETF tracking ONDO, the token powering real-world asset platform Ondo Finance.

-

Business9 месяцев ago

Business9 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion9 месяцев ago

Fashion9 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment9 месяцев ago

Entertainment9 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business9 месяцев ago

Business9 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Entertainment9 месяцев ago

Entertainment9 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton