Uncategorized

Why Doesn’t the U.S. Have a Bitcoin Reserve, Yet?

President Donald Trump sent a rush of excitement through the crypto industry when he ordered his administration to get to work on setting aside cryptocurrencies as a long-term investment for the U.S. government. But there’s been little to see from that effort, so far, and the officials behind the work seem to be suggesting the wait could be considerable.

Trump’s March directive to get started on the stockpile carried a now-expired deadline for the Treasury Department to figure out how to actually set up the reserves for the bitcoin and other crypto assets the government has at its disposal. By now, the administration is supposed to have a plan for the «accounts in which the Strategic Bitcoin Reserve and United States Digital Asset Stockpile should be located and the need for any legislation to operationalize any aspect of this order,» according to the president’s directive, which called for two separate heaps of crypto — one for bitcoin only and the other for all other digital assets.

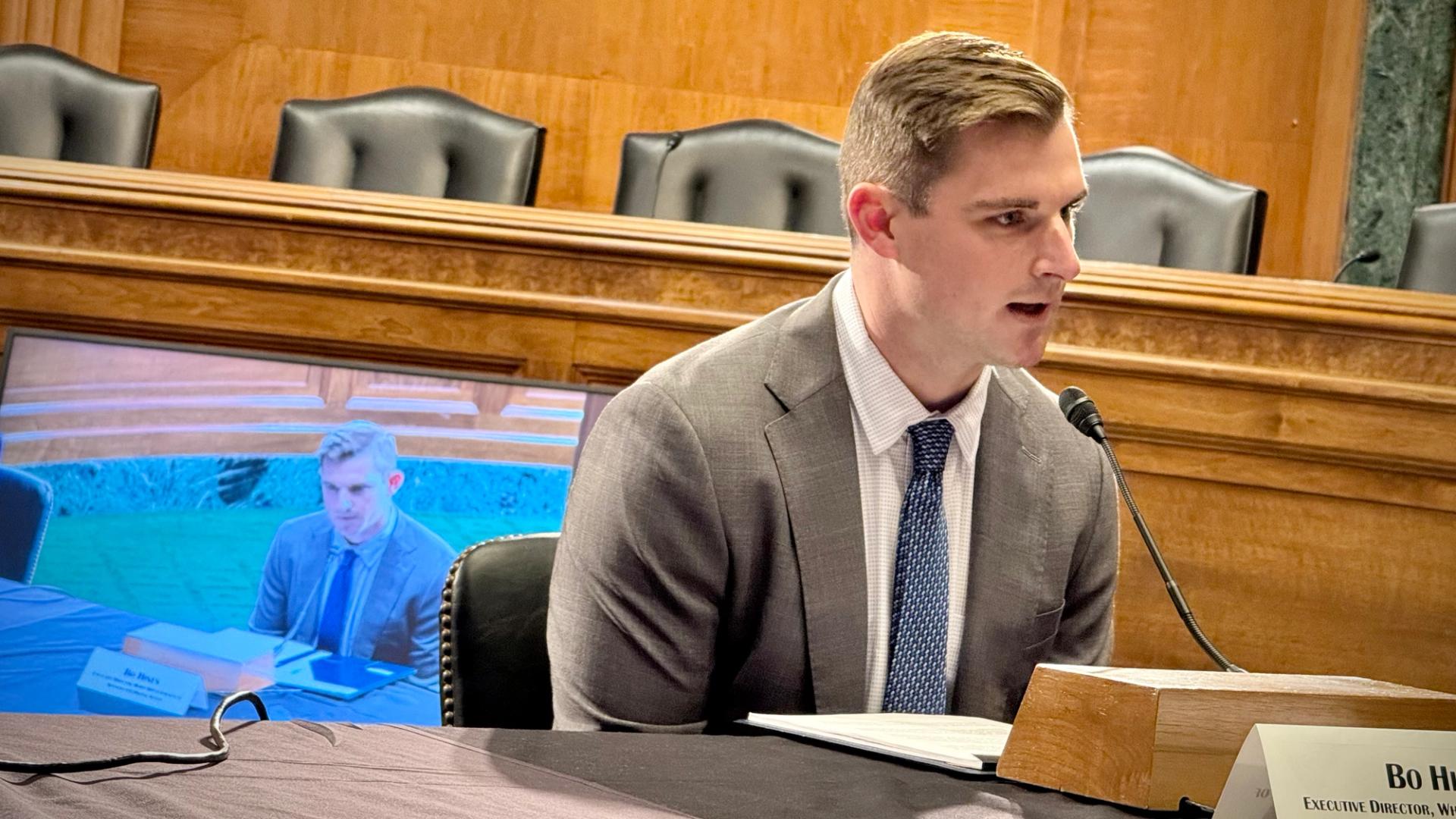

Such a plan hasn’t yet been revealed by Trump’s chief crypto advisers, including Bo Hines, who pointed out last week that «there’s nothing in the [executive order] that mandates that report becomes public,» Hines said of the document that was due in early May, though he added that the administration could «choose to make it public at some point.»

But Hines offered some update of the government-wide audit that aimed to figure out what assets the various federal agencies — including the U.S. Marshals Service — had gathered from civil and criminal seizures.

«They have received the numbers from the different entities inside the government,» he told reporters at an event on Capitol Hill, referring to Trump’s requirement that federal agencies report their crypto holdings to the Treasury by early April. «Now the process begins in terms of establishing the reserve, the actual infrastructure behind it.»

The executive order from Trump had affixed another federal stamp of approval on cryptocurrency after years of resistance from the previous administration and its regulators that viewed the field as prone to risk and recklessness that could endanger investors. The price of BTC has risen 25% since he issued the order.

“President Trump’s proclamations have laid a powerful foundation, but now it’s time to move from vision to execution,» said Hailey Miller, director of government relations at the Digital Chamber’s Digital Power Network, in an email suggesting industry folks are standing by to help. «The momentum is real. What we need now is coordinated follow-through.”

With the administration playing its cards close to the vest, the clearest view is on the legislators who are trying to get bills done to «operationalize» the order, as directed by Trump. Senator Cynthia Lummis has taken a lead in the Senate with her Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act aimed at «transforming the president’s visionary executive action into enduring law.»

Turning the U.S. into an outsized bitcoin investor has been a project of the Wyoming Republican for a while now, and she thinks it’s the answer to the nation’s fiscal worries. But Lummis, who chairs a digital assets subcommittee in the Senate, and others in favor of the reserves understand that there are more urgent priorities in crypto legislation.

Representative Nick Begich, an Alaska Republican pushing matching legislation in the House of Representatives, granted that the other crypto efforts to set up rules for the markets and stablecoins have to come first.

«But I’m very hopeful that after those are completed, we can turn the focus toward the BITCOIN Act and start having a serious discussion about why it’s important for the United States to have a diversified reserves balance sheet that includes bitcoin,» he said at a recent event in Washington.

Because the market structure and stablecoin bills are on uncertain timelines, despite Trump’s earlier ambition to get both done before Congress’ lengthy August break, it’s unclear how soon the lawmakers will have a window to consider the reserves. Senator Tim Scott, the chairman of the Senate Banking Committee, put a new September 30 goal on his chamber’s potential passage of the crypto market structure bill, but much depends on a House strategy for the two bills that hasn’t yet emerged.

Begich spoke of his House efforts as if he’s still trying to get them off the ground, asking crypto insiders to help convince their members of Congress to co-sponsor the bill.

Getting more sponsors «sends a signal to committee leadership that this is something that has the potential to pass into law,» he said.

«Having the support of the president is extremely important,» Senator Lummis noted. «So I’m hoping we can convince more in Congress to understand the fundamentals of Bitcoin.»

While the president was clear that he doesn’t want new taxpayer money spent to build crypto reserves, Trump’s order called on the administration to find other ways to purchase digital assets. Hines said federal officials are already working on multiple ideas to rake in «digital gold.»

«We are certainly keen on the idea of accumulation,» he said. «I think we’ll begin moving very quickly on that.»

The government has routinely been estimated to have about 200,000 bitcoin on-hand, though no further public accounting has yet emerged. The BITCOIN Act pushed by both Lummis and Begich would seek to buy about 5% of the global bitcoin supply — a million coins — over a five-year period, «mirroring the size and scope of gold reserves held by the United States.» To do so, it would try to unlock some novel funding approaches to avoid hitting taxpayers.

«There are several mechanisms available for the acquisition of bitcoin,» Begich said, including rewriting the rules of the Exchange Stabilization Fund to be able to acquire bitcoin and updating the modern market value of Federal Reserve gold certificates to leverage into bitcoin purchases.

Begich maintained that the leading digital asset is not just a niche financial instrument but something the government needs to embrace as a mainstay.

«We like to talk about bitcoin as though it’s somehow separate from the rest of the economy,» he said. «Bitcoin really is becoming an asset class that represents the economy.»

One of the conceptual challenges of this digital «strategic reserve» is that the underlying idea for a buy-and-hold government investment means this stockpile isn’t actually meant to be a strategic reserve in the traditional sense. Other nationally reserved commodities, such as oil, can be released when the nation has a special need. That’s not the plan for bitcoin in the minds of Trump and his lawmaker allies.

But as enthusiastic as they are, state lawmakers have jumped ahead of their federal counterparts in setting up state-based reserves. Trump’s order seemed to act as a starting gun for efforts across the country to devote public money to crypto investing. As the federal government continues its work, states such as Texas are already building their stockpiles.

Read More: Trump Orders ‘Fort Knox’ Bitcoin Reserve and Digital Assets Stockpile

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars