Uncategorized

99% of Crypto Tokens Are Going to Zero: Fund Manager

There’s never been a better time to allocate money to crypto hedge funds.

That’s according to Chris Solarz, the chief investment officer of digital assets at Amitis Capital, a firm which runs a crypto-focused fund of funds — meaning a fund that specializes in allocating capital to various money managers.

“This is the golden age for crypto hedge fund investing,» said Solarz, who used to be responsible for almost $8 billion in allocations at investor advisory firm Cliffwater, in an interview with CoinDesk. «It’s an alignment of the stars. This beta, this secular tailwind… blockchain as a whole has such potential. At the same time, the money manager universe is so scarce that I feel like I’m shooting fish in a barrel being able to pick the winners.”

Crypto markets are still so new that money managers are able to run the same trading strategies that they used to 35 years ago in TradFi, when hedge funds were only just emerging, Solarz said.

Only 127 hedge funds existed back in 1990, managing roughly $39 billion; by 2024, those numbers had skyrocketed to over 10,000 funds managing $5 trillion in assets. In other words, the sector got way more competitive — and it became much harder to outperform the market.

Solarz’s thesis is that the crypto sector (which counts roughly 1,650 hedge funds managing $88 billion in assets) is currently 10 times less competitive than traditional markets, to the point that money managers are able to dust off and readapt 20-year-old strategies that stopped working in TradFi over a decade ago due to commoditization.

“I meet 20 managers [in crypto]… 19 out of 20 don’t deserve to be running money,” Solarz said. “A lot of them are young and have never managed money before. They’ll say ‘We’re investing in bitcoin, ether and solana.’ And I’ll say, ‘Well, why am I paying you 20% for that?’ … When I pay 20% to a manager, I don’t want them to give me stuff that I can just do myself or buy in an ETF form.”

The crypto sector is likely to keep presenting asymmetric opportunities to money managers until the technology is completely integrated into the financial sector, according to Solarz. Nobody says they work for dot-com companies anymore, because every firm is a dot-com company. At some point, people will stop talking about crypto as something separate from the rest of the financial system, so the reasoning goes — possibly when bitcoin catches up to gold in terms of market capitalization, which Solarz thinks could happen within the next 10 years.

No altcoin season

There are three large categories of funds that Solarz looks at for allocation: venture funds (which provides capital to startups), liquid directional (funds that bet on whether the market will go up or down) and liquid market neutral (which earn to make money regardless of market moves).

When looking at liquid directional funds, Solarz is more interested in the manager’s process and risk management than specific theses they may espouse. What’s their investment strategy? Is it repeatable? How do they think about macroeconomics? Then he plows performance data points into models that determine how much value the manager is adding.

“It’s easy for me to avoid the big losers. It’s always hard to pick the winners,” Solarz said. “If something seems fishy or I don’t think they have a true investment process, it’s easy to pass on, but there’s always a little bit of luck involved as well to be the best out performer every single year.”

That process needs to be rigorous, because the days where all cryptocurrencies rise together — the fabled altcoin seasons — are over, or so he says. The crypto ecosystem now counts approximately 40 million tokens, by Solarz’ count, and he expects 99.99% of them to eventually go to zero. «There’s only 100 that are worth talking about,» he said.

The crypto market will need an injection of at least $300 billion to sustain current prices over the next three years, Solarz argues, because of the massive token unlocks that are scheduled to weigh down the top 100 tokens. The size of the liquid token market for hedge funds is around $30 billion, Solarz noted, and retail traders have moved on to memecoins. In other words, there’s currently nobody to buy up all of that supply.

“This is the overhang. This is why there can’t be an altcoin bull market in general for some time,” he said.

Market neutral strategies

Historically, five times more money has gone into crypto VC funds than into all of the crypto liquid funds combined, Solarz said, because venture investing makes it easier to hide mark-to-market losses from investment committees. This dynamic is one of the reasons why Amitis sees more opportunities on the liquid side. Solarz has allocated capital to 14 funds so far. Of these, three are VCs, four are liquid directional, and seven are liquid market neutral.

“This is a little bit glib, perhaps, but at the institutional level, they’re really trying not to lose money, while at the family office, we’re trying to compound returns,” Solarz said. “If there is a venture capital opportunity that seems incredible … I will consider investing, but the hurdle rate is so much higher if you’re locking up money for 10 years.”

Market neutral strategies are still very profitable, Solarz said. For example, traders were able to arbitrage the price of cryptocurrencies on South Korean exchanges back in December when President Yoon Suk Yeol declared martial law, creating a regional crisis. South Korean investors sold their assets in a panic, but the rest of the world did not, creating disparities in price that funds were able to take advantage of.

Another popular strategy involves benefitting from the funding rates associated with perpetual contracts. Institutional investors often short a cryptocurrency while gaining spot exposure to it at the same time; this allows them to remain perfectly market neutral while they collect interest on the perps, which can sometimes reach 30% annualized. That same strategy is deployed on spot bitcoin exchange-traded funds (ETFs) and the CME Group bitcoin futures.

“That’s what they’re doing in this category, they’re doing variations on this, and it’s still very profitable, double-digit returns and in a consistent manner,” Solarz said.

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

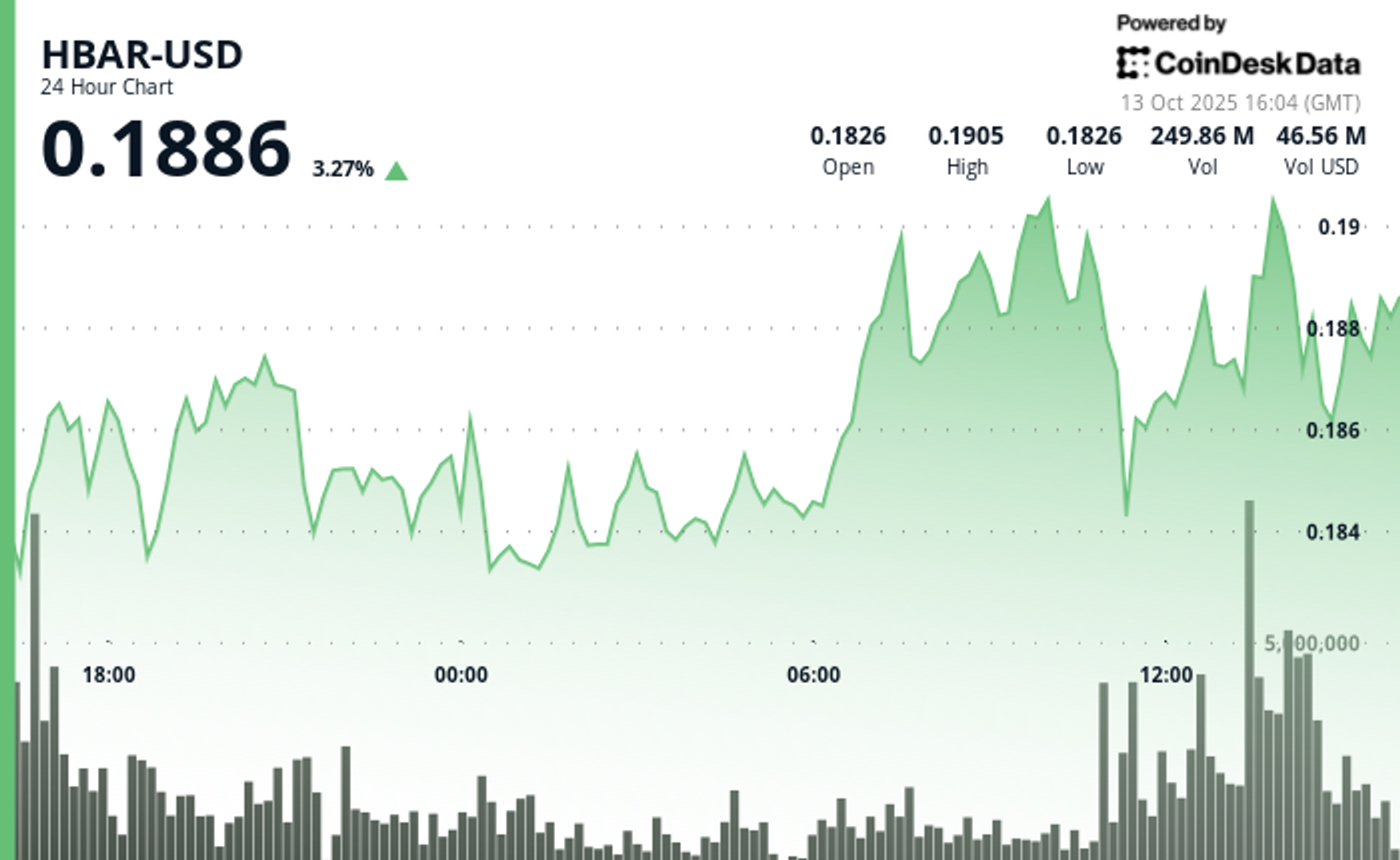

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton