Uncategorized

3 Ways Bybit’s $1.5 Billion Hack Will Impact the Staking Industry

The $1.5 billion hack of Bybit — the largest in crypto history — has put the entire industry on high alert. The attack, reportedly carried out by North Korea’s Lazarus Group, resulted in the theft of over 401,000 ETH, reinforcing the reality that no exchange is safe from sophisticated cyber threats, and any platform can be at risk.

Bybit’s response is critical. The positive takeaway is that Bybit has re-established a 1:1 asset backing for its clients and closed the “ether gap.” However, this temporary situation — where users shoulder the burden of centralized exchange (CEX) security failures could drive staking participants toward self-custody, keeping only the bare minimum on exchanges for transactions.

While the full fallout of this breach is still unfolding, it may serve as a catalyst for both retail and institutional staking participants to rethink their strategies. Here’s how the hack could reshape staking.

Potential Staking Losses

The hack resulted in the theft of approximately 400,000 ETH, which is nearly $1 billion in losses at an average price of $2,600 per ETH. Beyond the immediate financial hit, the Ethereum staking yield — hovering around 4% annually — means a loss of roughly 16,000 ETH in yearly staking rewards.

For perspective, if these stolen ETH were spread out across 100 stakers, each would have lost 160 ETH in rewards. This is a significant blow, particularly for retail investors who may lack the financial resilience to absorb such losses.

Declining Staking Share on Centralized Exchanges

The Bybit hack may be a turning point for the crypto industry, highlighting the risks of staking on centralized platforms. The trend is already visible in recent data: in the last six months, the amount of staked ETH on centralized exchanges has dropped from 8,597,984 ETH in September 2024 to 8,024,288 ETH in February 2025, representing a 6.67% decline. This change comes amid growing concerns about security and transparency on centralized platforms.

Additionally, following the hack from Feb. 20 to Feb. 23, staked ETH on CEXs fell by 0.56%, while on-chain staking (excluding CEXs) increased by 0.31%. This suggests a shift in the staking landscape, with users increasingly moving their assets away from centralized exchanges to more secure, non-custodial staking solutions or hardware wallets.

This change could have long-term implications for the crypto market. Centralized exchanges, which have long dominated the staking ecosystem, may see their influence wane. As stakers migrate to decentralized alternatives, CEXs’ roles in governance, reward distribution, and network upgrades could diminish. In the long-term, this may result in the reshaping of the staking market, with decentralized alternatives taking center stage.

Institutional Adoption at Risk

High-profile hacks like Bybit’s inevitably make institutional investors more cautious about entering the crypto market. When auditors evaluate staking products, including ETH ETFs, billion-dollar security breaches can prompt legal and compliance teams to hit the brakes on crypto allocations.

This stagnation could push back the timeline for achieving new price highs and delaying broader adoption.

Given the rising threat of hacks, it is crucial for both retail and institutional investors to embrace audited and certified self-custody solutions. Securing assets through non-custodial wallets and decentralized platforms can significantly mitigate the risks posed by centralized exchanges. At the same time, exchanges need to work to rebuild trust by enhancing their security measures, conducting regular audits, and offering insurance schemes for users affected by breaches.

Moreover, the entire crypto community — including developers, exchanges, regulators, and users — needs to come together to balance innovation with security. This collaboration is essential for the long-term viability of the industry. By strengthening the overall security infrastructure, we can create an environment where both retail and institutional participants can confidently engage with the crypto market.

Uncategorized

Fed’s Sept. 17 Rate Cut Could Spark Short-Term Jitters but Supercharge Bitcoin, Gold and Stocks Long Term

Investors are counting down to the Federal Reserve’s Sept. 17 meeting, where markets expect a quarter-point rate cut that could trigger short-term volatility but potentially fuel longer-term gains across risk assets.

The economic backdrop highlights the Fed’s delicate balancing act.

According to the latest CPI report released by the U.S. Bureau of Labor Statistics on Thursday, consumer prices rose 0.4% in August, lifting the annual CPI rate to 2.9% from 2.7% in July, as shelter, food, and gasoline pushed costs higher. Core CPI also climbed 0.3%, extending its steady pace of recent months.

Producer prices told a similar story: per the latest PPI report released on Wednesday, the headline PPI index slipped 0.1% in August but remained 2.6% higher than a year earlier, while core PPI advanced 2.8%, the largest yearly increase since March. Together, the reports underscore stubborn inflationary pressure even as growth slows.

The labor market has softened further.

Nonfarm payrolls increased by just 22,000 in August, with federal government and energy sector job losses offsetting modest gains in health care. Unemployment held at 4.3%, while labor force participation remained stuck at 62.3%.

Revisions showed June and July job growth was weaker than initially reported, reinforcing signs of cooling momentum. Average hourly earnings still rose 3.7% year over year, keeping wage pressures alive.

Bond markets have adjusted accordingly. The 2-year Treasury yield sits at 3.56%, while the 10-year is at 4.07%, leaving the curve modestly inverted. Futures traders see a 93% chance of a 25 basis point cut, according to CME FedWatch.

If the Fed limits its move to just 25 bps, investors may react with a “buy the rumor, sell the news” response, since markets have already priced in relief.

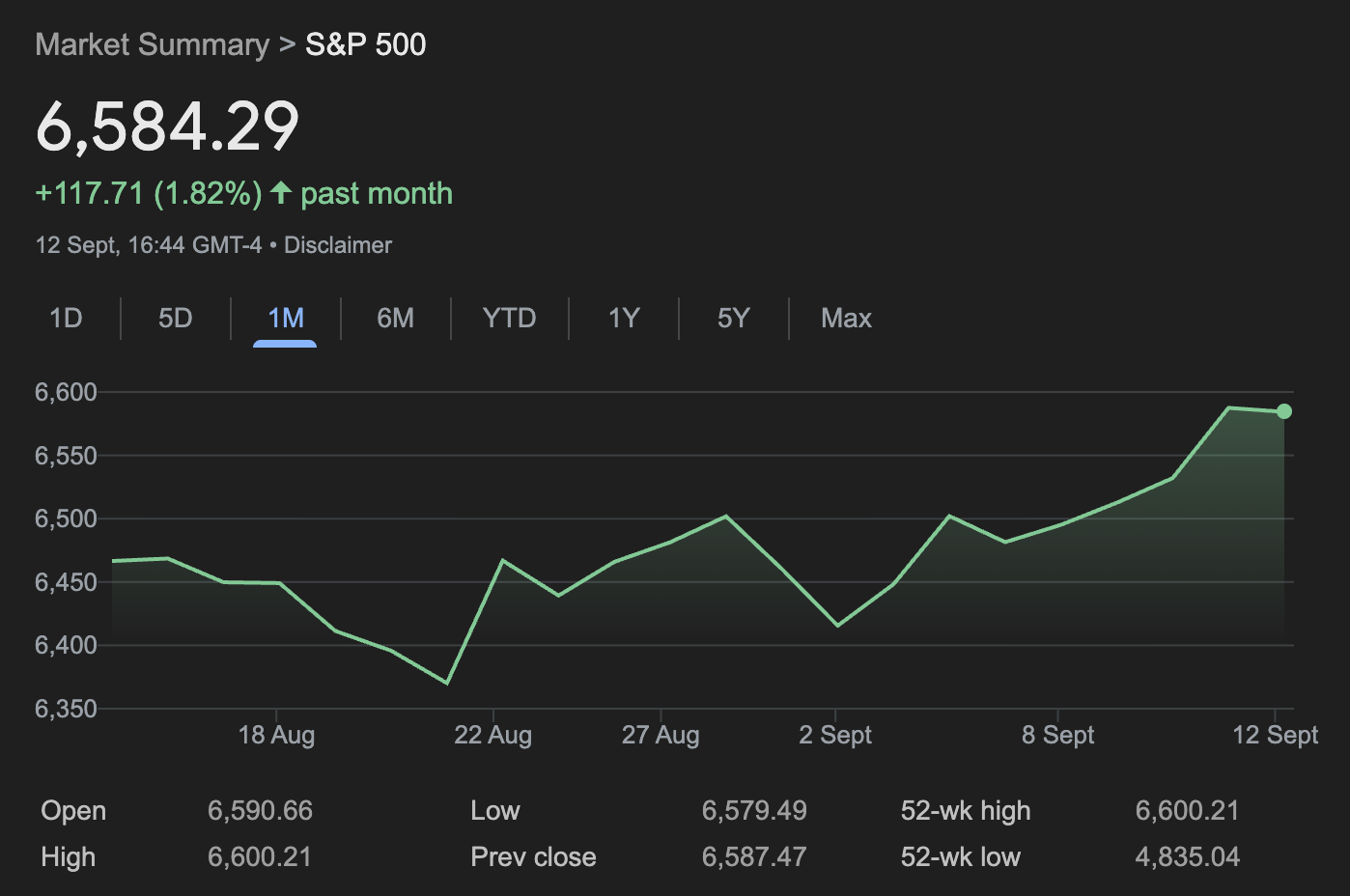

Equities are testing record levels.

Equities are testing record levels. The S&P 500 closed Friday at 6,584 after rising 1.6% for the week, its best since early August. The index’s one-month chart shows a strong rebound from its late-August pullback, underscoring bullish sentiment heading into Fed week.

The Nasdaq Composite also notched five straight record highs, ending at 22,141, powered by gains in megacap tech stocks, while the Dow slipped below 46,000 but still booked a weekly advance.

Crypto and commodities have rallied alongside.

Bitcoin is trading at $115,234, below its Aug. 14 all-time high near $124,000 but still firmly higher in 2025, with the global crypto market cap now $4.14 trillion.

Gold has surged to $3,643 per ounce, near record highs, with its one-month chart showing a steady upward trajectory as investors price in lower real yields and seek inflation hedges.

Gold has climbed steadily toward record highs, while bitcoin has consolidated below its August peak, reflecting ongoing demand for alternative stores of value.

Historical precedent supports the cautious optimism.

Analysis from the Kobeissi Letter — reported in an X thread posted Saturday — citing Carson Research, shows that in 20 of 20 prior cases since 1980 where the Fed cut rates within 2% of S&P 500 all-time highs, the index was higher one year later, averaging gains of nearly 14%.

The shorter term is less predictable: in 11 of those 22 instances, stocks fell in the month following the cut. Kobeissi argues this time could follow a similar pattern — initial turbulence followed by longer-term gains as rate relief amplifies the momentum behind assets like equities, bitcoin, and gold.

The broader setup explains why traders are watching the Sept. 17 announcement closely.

Cutting rates while inflation edges higher and stocks hover at records risks denting credibility, yet staying on hold could spook markets that have already priced in easing. Either way, the Fed’s message on growth, inflation, and its policy outlook will likely shape the trajectory of markets for months to come.

Uncategorized

Your Company Probably Doesn’t Need Its Own L2

More and more companies are attracted to the idea of launching their own Ethereum layer 2 network. Most of them shouldn’t bother. There’s already a staggering number of them — over 150. Quite a few of these are centralized and linked to a single enterprise and several companies such as Robinhood have recently announced plans to launch their own layer 2 networks.

The attractions for launching an Ethereum layer 2 network are significant, especially when compared to launching your own layer 1 (foundation layer) blockchain. Layer 1 networks must compete with networks like Ethereum and Solana in an already intensely competitive and crowded market. Layer 2 networks that run on top of Ethereum also face an intensely competitive marketplace but can simultaneously draw upon the strength of the Ethereum ecosystem, thanks to deep integration into Ethereum itself.

With Ethereum having turned 10 in July, it remains the dominant smart contract blockchain and it is the largest single home for digital assets, real-world assets (RWA), stablecoins and decentralized finance applications. Ethereum’s share of the overall decentralized finance ecosystem has been stable at about 50% for three years now. When layer 2 networks are included in the total, it appears to be rising modestly.

The temptation to launch your own Ethereum layer 2 network is easy to understand — they look like a useful concept with great economics. A layer 2 network on top of Ethereum offers a bit of “best of both worlds” functionality: you can control your own ecosystem within your layer 2 but retain integration with and access to the overall Ethereum ecosystem. Centralized layer 2 networks can set their own price structures and have nearly all the same controls as a stand-alone private blockchain such as deciding who has access to the network and what kind of data will be visible to others.

This comes with a cost. Layer 2 networks must purchase transaction processing space on the Ethereum mainnet to finalize their transactions (known as blob space) — but those costs are likely to be lower than those associated with starting a network from scratch and competing head-on with Ethereum. In fact, according to Token Terminal, the costs of developing a layer 2 are remarkably low. For Base, a layer 2 network run by Coinbase, during June of 2025, the network generated $4.9 million in fee revenue and spent just $50,000 on layer 1 settlement fees.

Indeed, the layer 1 settlement fees on Ethereum are so low they have set off a fiery debate within the network ecosystem about whether they are too low, and that layer 2 networks represent a transfer of benefits from layer 1 stakeholders to layer 2 networks. It is likely this will result in some re-balancing of fees, but even a 10x increase in fees is not likely to alter the fundamentally good value proposition that comes with scaling with layer 2 networks.

Furthermore, the recent announcement by Robinhood that they will be building their own layer 2 network on Ethereum fundamentally validates the overall layer 2 thesis within Ethereum: layer 2 networks are not only a good scaling option, they also enable a variety of business models that will entice a wide range of companies to join the network.The layer 2 ecosystem is likely to have a range of participants from the fully decentralized to the completely centralized.

And this brings us to the key question: does your company need its own layer 2 network? Chances are, you don’t. The real value proposition of a blockchain ecosystem is the ability to work in cooperation with others without any one party controlling the network. If you’re a manufacturing company, for example, you want to work with your suppliers and customers on a level playing field with your competitors. Blockchains let everyone join in without favoring any one participant. In the long run, working together on a level playing field is much cheaper and preferable to trying to integrate into different systems controlled by each one of your key customers or suppliers.

While some layer 2 networks look very profitable right now, this is only true if you can generate good transaction volume. Many of the layer 2 networks operating are doing little to no business as they struggle to differentiate themselves in a crowded market. According to L2Beat, most of these networks have less than $1mm in TVL bridged in from Ethereum and are averaging less than one user operation per second.

So when does a company need its own layer 2 network? My hypothesis is that this works best for firms that can aggregate significant transaction volume into the network and whose customers do not have the means or the individual volume to make their own direct connection to Ethereum. Right now, that largely means financial services firms that have thousands or millions of retail customers, from Coinbase to Kraken to Robinhood. More firms will surely follow. Having a layer 2 network might be seen, in the future, the way we looked at having a seat on the New York Stock Exchange. Brokerage firms would want them, but a car maker wouldn’t find value in it.

Three questions would be useful in determining if a firm should launch its own Ethereum layer 2 network: first, is the company able to aggregate a significant volume of its own transactions or clients compared to other networks? Second, is transacting on-chain central to the company’s core business model (e.g., are you an intermediary, especially a financial one that presently transacts on traditional financial rails). Lastly, does your layer 2 approach offer a differentiated value proposition compared to the many other network options out there? If you can say yes to all three options, this is a possible path forward.

For most other types of firms, they may find the optimal value proposition to be connecting directly to Ethereum, or one of the other open layer 2 networks. It will be less costly and more private than going through an aggregator who will be able to mark up your transaction costs and see your transaction flow and less costly than running your own network.

I suspect, however, that before we are done, quite a few firms that have no need to run their own layer 2 will launch one anyway for the same reasons many firms launched private chains in the past.

No matter how reliably they have failed, the attraction of private blockchains was always hard to counter. The allure of “controlling your destiny” and “taxing the ecosystem” was hard to resist. Public chains, with their openness, interoperability, and permissionless nature can look scary to business users who would prefer more control.

To the same buyers who wanted private chains, centralized layer 2 networks look like a halfway house that may seem appealing. Unlike private chains, I don’t think they are all doomed to fail, but I do suspect only a few will succeed. History keeps repeating itself — mostly because we’re not very good at paying attention to it. Here we go again.

Disclaimer: These are the personal views of the author and do not represent the views of EY.

Uncategorized

Memecoins Rally as Traders Bet on Fed Rate Cut and U.S. Altcoin ETFs

The memecoin sector is heating up as fresh altcoin season talks are starting to grow on social media, partly driven by expectations that the Federal Reserve will this coming week cut interest rates, a boon for risk assets.

Bitcoin’s market dominance has dropped 3.5% in the past month, and its underperformance relative to altcoins has now seen altcoin season indexes, which measure the performance of top cryptocurrencies against BTC, enter “altseason” territory.

Altseason, short for altcoin season, refers to a period in which alternative cryptocurrencies significantly outperform bitcoin. It often starts as capital rotates out of bitcoin amid growing risk appetite.

Those include indexes from CoinMarketCap and CoinGlass. Over the last 24 hours bitcoin moved up just 0.3%, while the CoinDesk Memecoin Index (CDMEME) rose 7.1%.

Pushing up prices in the CDMEME index are some tokens like SHIB and BONE, which recently puzzlingly surged after Shiba Inu’s layer-2 network Shibarium suffered a flash loan exploit.

The growing performance of altcoins stems from growing risk appetite, as lowering interest rates makes safer investments like government bonds less appealing. This renewed risk appetite is fueling a cascading rotation of capital across markets.

Traders on prediction market Polymarket now see a 92% chance that the Federal Reserve will cut interest rates by 25 basis points this month, and a 7% chance that rate will be 50 bps. On the CME’s FedWatch tool, odds of a smaller cut are at 93%, while odds of a larger cut are at 6.6%.

Against this backdrop, a wave of altcoin exchange-traded funds (ETFs) is in line to hit U.S. markets in the last quarter of the year if these are approved. These even include a DOGE ETF and a TRUMP ETF.

If approved, these ETFs could bring more retail and institutional investors into the altcoin space by offering regulated access to cryptocurrencies beyond BTC and ETH, whose spot ETFs in the U.S. have amassed billions in assets.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars